Myfxbook

Myfxbook is a leading forex website. Essentially, it helps manage your forex portfolio. Importantly, it allows real-time tracking of your trading accounts.

One key feature is Performance Analysis. In other words, it lets you measure your trading performance. This is done using various metrics such as profit percentage and drawdown.

Next, there’s the AutoTrade Service. This lets you copy successful traders’ moves. So, if you’re a successful trader, you can earn extra by letting others copy you.

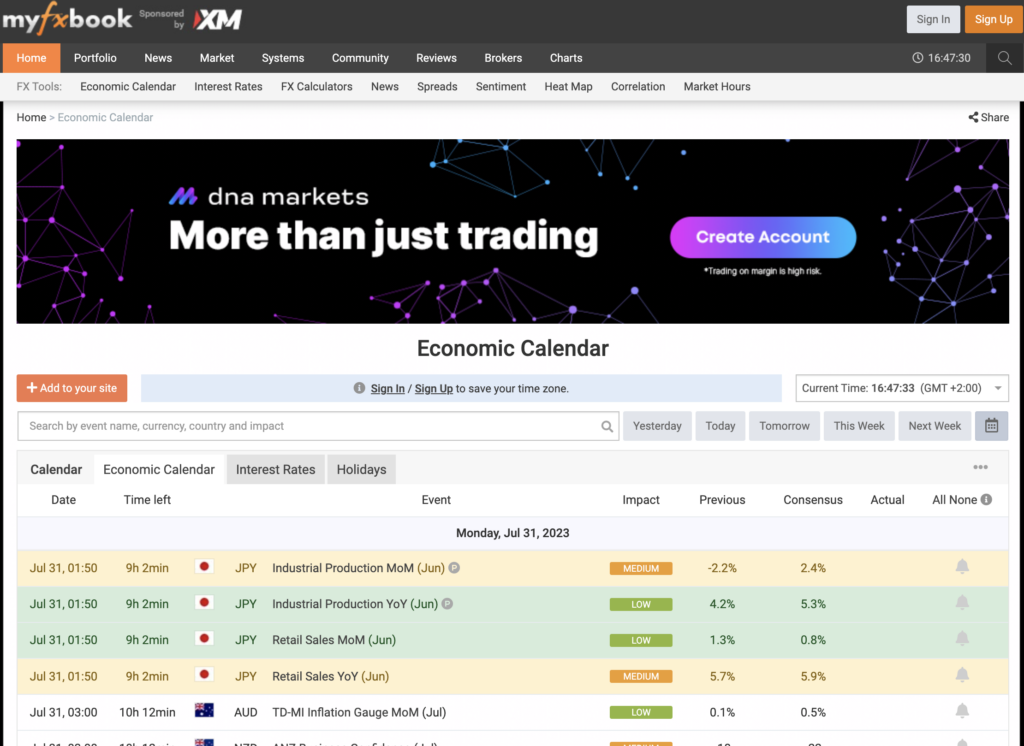

They also offer an Economic Calendar. This is a live calendar covering important market events. It keeps you updated about news affecting forex markets.

Another feature is the Community Outlook. Basically, it shows you what the Myfxbook community is trading. It’s a great way to gauge overall market sentiment.

Then, there are Forex Charts. These provide up-to-date visuals for various currency pairs. It makes market trends easier to understand.

Systems is another noteworthy feature. Here, traders share their strategies. You can follow strategies based on their ranking and performance.

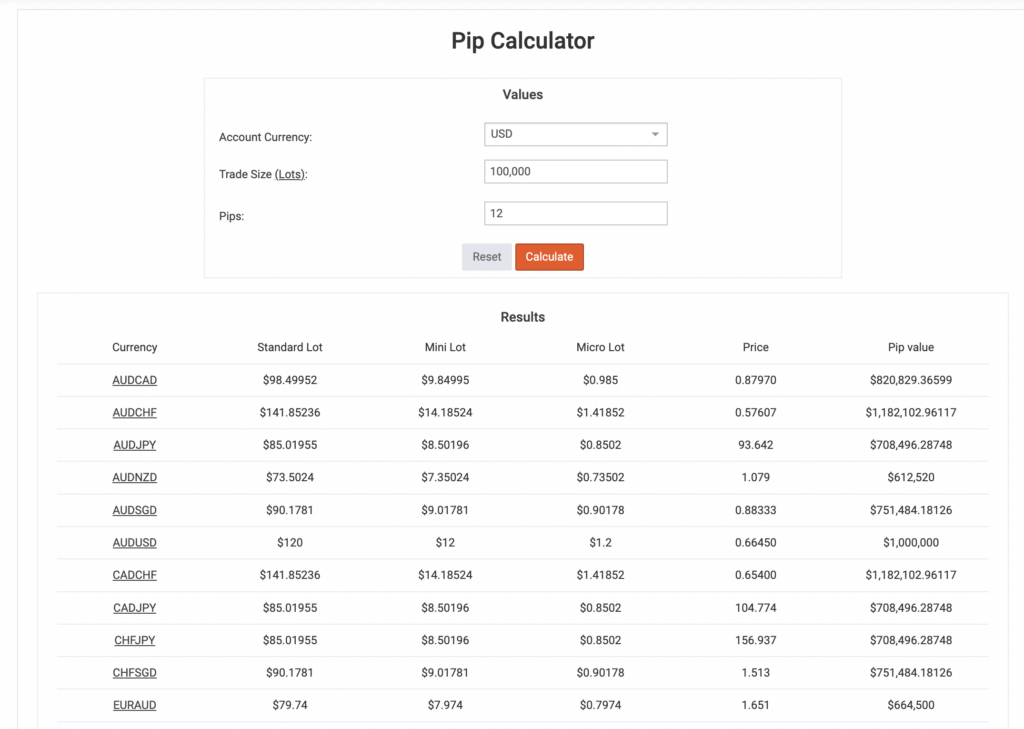

Myfxbook also offers Forex Calculators. These help with decision-making. For instance, there are calculators for pips, margins, and risk.

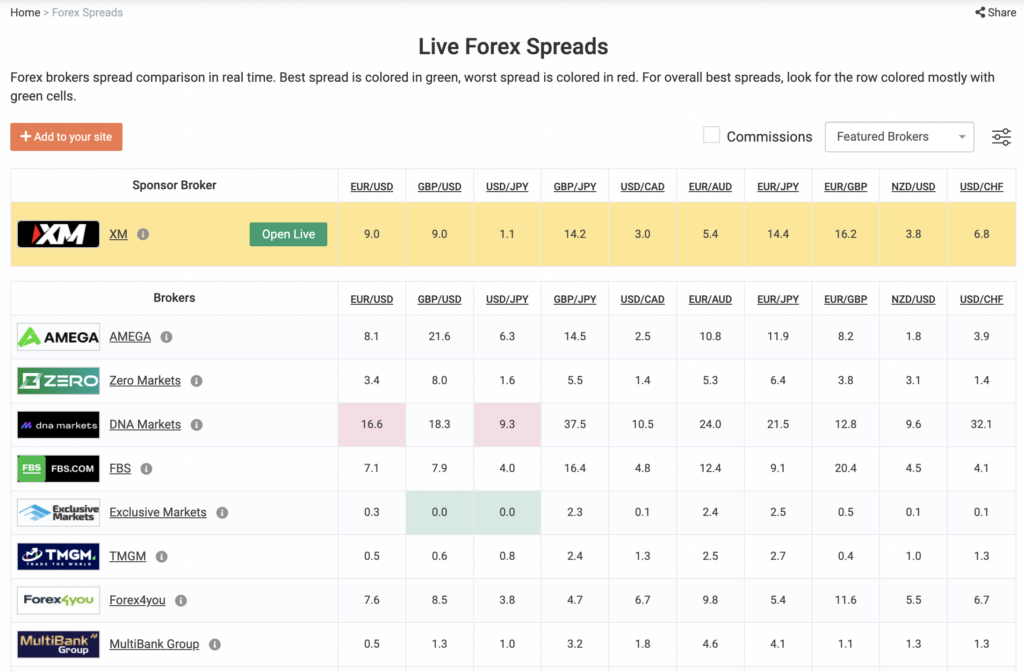

Lastly, there’s a Broker Spreads Comparison tool. This allows you to compare real-time spreads from different brokers. It helps you make informed trading decisions.

Performance Analysis at Myfxbook

Performance Analysis is a tool on Myfxbook. In short, it helps you track your trading effectiveness. It uses various measures for this purpose.

One such measure is the Drawdown. It shows the biggest drop in your balance. Essentially, it’s a gauge of risk and loss.

Then, there’s the Profit Percentage. It shows how much your account has grown or shrunk. It’s an easy way to see your gains or losses.

There’s also Absolute Gain. Unlike Profit Percentage, it considers all deposits and withdrawals. It’s a measure of your net gain or loss.

Moreover, there’s the Gain chart. This visualizes your account balance over time. It’s useful for tracking your progress.

Lastly, there’s the Daily and Monthly chart. It breaks down your gains or losses by day and month. It helps identify your successful and challenging periods.

Importantly, using these metrics helps spot trends. It also aids in adjusting your strategies.

The AutoTrade Service

AutoTrade is a feature provided by Myfxbook. Simply put, it allows you to follow successful traders.

How does it work? It copies the trades of profitable traders. Consequently, you can mimic their success.

For traders with a solid track record, it’s a boon. They can offer their trades for copying. Then, they get compensated for it.

There’s an important benefit for new traders too. They can learn from experienced traders. Thus, it serves as a form of mentorship.

However, you can’t just follow anyone. Only traders with a proven record are eligible. Hence, it maintains a standard of quality.

AutoTrade shows each trader’s performance stats. Therefore, you can make informed decisions about whom to follow.

Myfxbook’s Economic Calendar

Myfxbook provides an Economic Calendar. Simply put, it’s a schedule of market-impacting events. It gives you real-time updates.

Each event comes with a time and date. So, you can plan your trades accordingly. It aids in timing your market moves.

Important economic data is included. For instance, it covers unemployment rates and GDP growth. These factors can significantly impact the forex market.

Forecasts for each event are also displayed. They predict the outcome based on expert opinions. Thus, it’s a glimpse into possible market reactions.

After the event, actual results are posted. You can compare them with the forecast. This comparison can help analyze market behavior.

Lastly, the calendar ranks events by their impact level. It allows you to prioritize high-impact events. Hence, it assists in focusing on key market changes.

Community Outlook

Community Outlook is a unique tool offered by Myfxbook. In essence, it shows what Myfxbook users are trading. It represents the collective sentiment of the community.

It provides a live view of open positions. You see the percentage of users buying or selling a currency pair. This data offers a glimpse into market sentiment.

Each currency pair gets its own display. This allows you to view sentiment on specific pairs. It can guide your trading decisions.

It’s not just about individual pairs. There’s also a summary of all pairs. It shows the overall sentiment of the Myfxbook community.

There’s also data on pending orders. This gives insight into future market actions. It hints at possible upcoming trends.

Myfxbook’s Forex Charts

Forex Charts is a feature provided by Myfxbook. Basically, it offers real-time graphical representations of currency pairs. These charts help visualize market trends.

Every chart shows price movements over time. This lets you track how a currency pair is performing. It helps identify potential trading opportunities.

Different time frames can be chosen. You might view charts over hours, days, or months. This flexibility suits different trading styles.

Various types of charts are available. For example, there are line, bar, and candlestick charts. Each offers a unique way to interpret price data.

The charts also allow for technical analysis. This includes drawing trend lines or adding indicators. These tools help predict future price movements.

Myfxbook Systems

Systems is an interesting feature of Myfxbook. Essentially, it’s a place where traders share their strategies. These strategies are then available for others to follow.

Each system is ranked based on performance. This makes it easy to spot the top-performing strategies. It can guide your trading decisions.

The details of each system are transparent. It includes the strategy’s gain, drawdown, and number of followers. This provides a comprehensive view of the system.

The comments section is also valuable. Here, users discuss a system’s performance. It gives a sense of community feedback on the strategy.

You can choose to follow a system. By doing so, you mimic its trades. This can potentially improve your trading results.

FX Calculators

Forex Calculators are tools provided by Myfxbook. In essence, they help traders make calculations related to their trades. They assist in making informed decisions.

The Pip Calculator is one such tool. It helps you determine the value of a pip in your account currency. This is useful for calculating profit or loss.

Next, there’s the Margin Calculator. This one helps you calculate the margin needed to open a position. It helps in understanding how much you’re risking.

Another tool is the Risk Calculator. This helps you calculate the risk involved in each trade. It helps you manage your risk more effectively.

Finally, there’s the Swap Calculator. It calculates the interest you’ll earn or owe if you hold a position overnight. It assists in understanding the cost of keeping trades open.

Broker Spreads Comparison

Broker Spreads Comparison is a feature on Myfxbook. Simply put, it allows you to compare real-time spreads from forex brokers. It guides you in choosing the right broker.

Each broker’s spread is displayed live. These spreads refer to the difference between the bid and ask prices. It helps determine trading costs.

The comparison is not limited to one currency pair. You can compare spreads across various pairs. This assists in selecting the best broker for specific pairs.

Additionally, the tool provides a historical view. You can view how spreads have changed over time. It aids in understanding a broker’s consistency.

Furthermore, there’s a ranking system. Brokers are ranked based on their spreads. This makes it easy to spot the ones with the lowest spreads.

However, it’s important to remember one thing. Low spreads aren’t the only factor to consider. Broker reliability, regulation, and customer service are equally important.

Myfxbook can enhance your trading experience

Myfxbook is an exceptional resource for forex traders. With features ranging from Performance Analysis to Broker Spreads Comparison, it serves as an extensive toolkit for managing your forex portfolio and making informed trading decisions. Remember, while these tools provide invaluable insights, they should be used in combination with other forms of analysis and market research. Always keep in mind the complexities and risks involved in forex trading. No tool can guarantee success, but with careful use, Myfxbook can undoubtedly enhance your trading experience.