Getting Started with ICT Trading in Forex: A Beginner’s Comprehensive Guide

Embarking on the journey of Forex trading? ICT trading, known for its robust approach to understanding the market’s dynamics, can be your ally. Short for Inner Circle Trader, the ICT trading strategy is gaining traction among traders worldwide. This approach prioritizes price action, overlooking excessive reliance on trend-following or momentum indicators. In this revamped guide, unlock the essentials of ICT trading from scratch, offering you a clearer path in the complex world of Forex.

Unveiling ICT Trading

Starting your journey in ICT trading? This is where it begins. You dive deeply into fundamental concepts. What sets it apart? The emphasis on price action. No excess information, just a detailed view of market movements.

Imagine observing the market’s heartbeat. You notice rhythms and patterns, gaining hidden insights. With ICT trading, this becomes your reality. You sync with the market, staying alert and aware. You navigate with clearness and accuracy.

Avoiding many technical indicators, ICT trading simplifies your approach. You’re not overwhelmed with endless signals. Your focus stays on key areas like liquidity and displacement. You grasp the shifts in market structure. This method gifts you a broad perspective. It’s more than a strategy; it’s a complete approach to the Forex marketplace.

Why focus on liquidity? It’s vital in ICT trading. Comprehending buy-side and sell-side liquidity lets you foresee market movements effectively. This knowledge grants you a unique advantage, letting you make informed, real-time decisions.

Displacement

Now, consider displacement. It appears as a group of candles positioned in the same direction on a chart. Recognizing this can be a game-changer. It signals strong buying or selling pressure, allowing you to adjust your trading strategy accordingly.

Market structure shifts are another essential concept in ICT trading. Recognizing when a trend is broken is crucial. This understanding empowers you to align your trading strategies with market realities. It ensures you aren’t caught off guard by sudden market changes.

Furthermore, the ICT trading methodology helps you identify optimal trade entries. Utilizing the Fibonacci drawing tool, you can pinpoint the best places to enter a trade. This tool is invaluable, enhancing your trading efficiency and effectiveness.

In conclusion, embarking on the ICT trading journey is a step towards mastering the Forex market. By focusing on core concepts and utilizing key tools, you set yourself up for success. With ICT trading, you are not just participating in the market; you are mastering it, armed with insight, clarity, and a robust strategy tailored for success.

Exploring ICT Trading Strategy

Entering the realm of ICT trading strategy lights the way to deeper insight. Here, attention swiftly shifts to the complex mosaic of the forex market. The ICT trading strategy highlights the deep importance of liquidity, exploring buy-side and sell-side details thoroughly. Beyond basic chart analyses, it provides a guiding light into possible price shifts and crucial market changes.

Navigating through this realm, the ICT trading strategy emerges as a robust tool for traders. It meticulously highlights optimal points of entry and exit, steering traders towards informed and strategic decisions. Moreover, it empowers traders to adeptly identify and respond to displacement and market structure shifts. This crucial knowledge, seamlessly integrated into the trading process, enhances the ability to predict and react to market trends with unerring precision.

In the quest for forex mastery, employing the ICT trading strategy stands out as a compelling approach. It consistently offers a lens of clarity, precision, and strategic insight in the often tumultuous world of forex trading. In essence, the ICT trading strategy is not just a method; it’s a comprehensive, enlightening journey towards achieving consistent trading success and robust market navigation.

Liquidity in ICT Trading

In the world of ICT trading, delving into the concept of liquidity is not just beneficial; it’s essential. It stands as a cornerstone, holding paramount importance in shaping your trading strategies. So, what’s it all about?

Now, picture the market chart. Here, liquidity is categorized into two main types: buy-side and sell-side. These represent specific levels on the chart where traders, whether they’re going long or short, position their stops. But that’s not all. It’s about understanding the mindset of other traders and anticipating their moves. It’s about navigating the market with foresight.

Consider the ‘smart money’ players in the market. They’re fully aware of these liquidity levels, and they use this knowledge to their advantage. They often accumulate or distribute positions near these levels where many stops are positioned. Understanding this can be your key to deciphering potential price movements and reversals. It becomes a compass, guiding you in planning your entry or exit points with more precision and confidence.

Let’s delve deeper

By understanding liquidity, you grasp the pulse of the market. You see where the price may potentially reverse course, seeking liquidity at the opposite extreme. This insight is not just information; it’s empowerment. It enables you to move in sync with the market, not against it, ensuring you are on the right side of trades more often than not.

But wait, there’s more. Understanding liquidity in ICT trading also paves the way for recognizing displacement and market structure shifts, other crucial components of the ICT trading methodology. It builds a solid foundation, helping you stand firm even when the market waters are turbulent.

In essence, mastering liquidity in ICT trading is like having a map in the intricate world of forex trading. It’s about making informed decisions, planning strategies with precision, and ensuring your journey in the trading world is not left to chance. It is a step towards trading mastery, providing you the clarity and insight needed for navigating the market with confidence and success.

So, why wait? Dive into understanding liquidity in ICT trading and equip yourself with a robust tool that enhances your trading acumen, setting you on the path to consistent trading success.

Delving Into Displacement in ICT Trading

In the intricate realm of ICT trading, another essential concept that demands your attention is displacement. It’s not just a term; it’s a significant phenomenon that can illuminate the path of your trading journey. But what is it, and why is it so critical in ICT trading?

Imagine observing a robust move in price action, resulting in a tidal wave of buying or selling pressure. This is displacement, a forceful movement in the market that echoes the sentiments and decisions of myriad traders across the globe. Recognizing these potent movements is more than beneficial; it’s crucial. It assists you in anticipating potential market shifts, allowing you to adapt your trading decisions timely and effectively. And this, in the world of trading, is priceless.

Now, let’s delve a bit deeper. Displacement typically emerges after a breach of a liquidity level. It appears as a group of candles moving vigorously in one direction, showcasing strong momentum and minimal disagreement between buyers and sellers. It’s a visual representation of conviction and consensus in the market, providing you with a clear signal to assess and act upon.

A multifaceted view of the market

However, that’s not all. Displacement in ICT trading is not just an isolated concept; it’s intertwined with other vital aspects of trading. It highlights its essential role in the comprehensive ICT trading methodology, offering you a multifaceted view of the market. Understanding displacement empowers you with the ability to see the larger picture, to move beyond isolated price movements and view the market in its interconnected complexity.

Moreover, displacement also plays a pivotal role in signaling the creation of Fair Value Gaps and Market Structure Shifts. These are key elements that further accentuate the importance of understanding displacement in your trading journey. It becomes a beacon, helping you navigate the sometimes turbulent waters of the forex market, ensuring you make decisions that are informed, timely, and strategic.

In conclusion, delving into displacement in ICT trading is not just a learning endeavor; it’s an investment in enhancing your trading insight and acumen. It equips you with the knowledge to navigate the market with increased confidence and precision, ensuring your trading decisions are not just guesses, but well-informed strategies poised for success. So why wait? Immerse yourself in understanding displacement and elevate your trading journey to new heights of success and proficiency.

Mastering Market Structure Shifts in ICT Trading

Embarking on the journey of ICT trading? Steer your attention to the pivotal concept of understanding market structure shifts. It’s not merely an element of trading; it stands as a cornerstone in the robust structure of ICT trading methodology. Why? Let’s embark on an exploratory journey to understand this.

Imagine standing at a juncture on a chart where the preceding trend breaks. This is what market structure shifts refer to, a point of transformation, signaling a potential whirlwind change in the market direction. It’s like a compass, directing you towards a possible alteration in the market’s tide. Understanding these shifts is not just essential; it’s paramount for mastering the art and science of ICT trading.

But how does this insight benefit you as a trader? It equips you with a powerful tool: foresight. It enables you to see the brewing storm in the market, allowing you to adapt your trading strategies proactively. This proactive adaptation is not just a change; it’s an alignment with the evolving and often unpredictable market trends. It’s your shield, safeguarding your investments and steering you clear from potential trading pitfalls.

A broken trend

Furthermore, a market structure shift often reveals itself at a level where a trend breaks, either upward or downward. If prices were rising, this shift appears where a lower low is made. Conversely, in a declining trend, it’s where a higher high occurs. This critical insight is more than just a data point. It’s your guide in the complicated labyrinth of the forex market, aiding you in making calculated and strategic trading choices.

Additionally, comprehending market structure shifts in ICT trading is akin to having a trustworthy map in the fluid world of forex trading. It highlights paths to follow and avoid, ensuring your journey is free from avoidable errors and unexpected obstacles. It’s a companion in your trading voyage, ensuring each step taken is a stride towards potential success.

In wrapping up, mastering market structure shifts in ICT trading isn’t optional. It’s essential for traders aiming not just to survive, but to flourish in the lively world of forex trading. It’s your beacon, steering you through the market’s intricate pathways, ensuring each move is rooted in insight and confidence. So, take the plunge, grasp market structure shifts, and see your ICT trading journey evolve, guiding you to peaks of trading success and steadiness.

Utilizing ICT Concepts in Platforms for Enhanced Trading

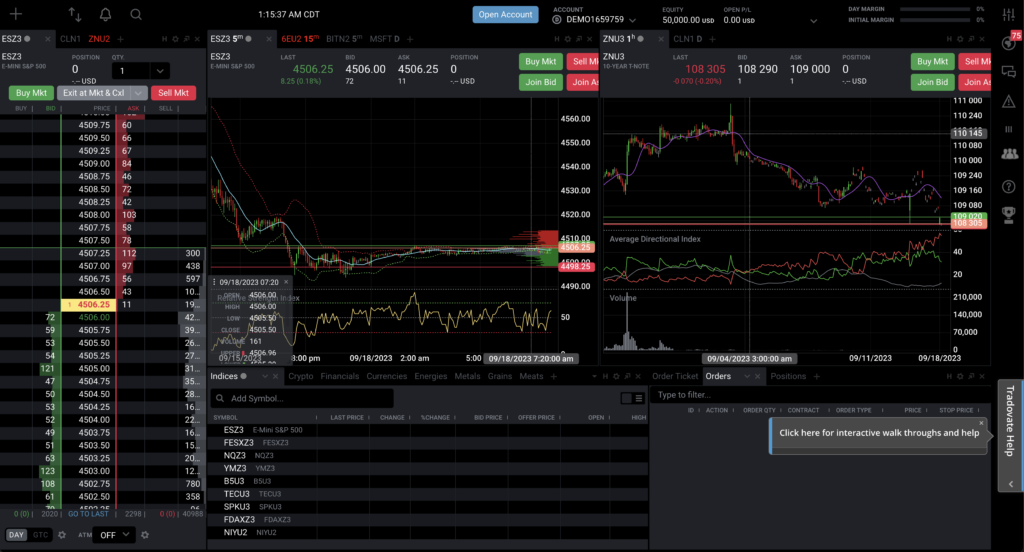

In the domain of trading platforms, a palpable surge of innovation is unmistakably noticeable. Platforms like TrendSpider stand out as more than ordinary trading interfaces. They have seamlessly woven ICT concepts into their core operations. But what makes this integration stand out? This smooth blend markedly bolsters traders’ capabilities to apply these crucial trading strategies with enhanced efficiency and effectiveness. It signifies the commencement of a groundbreaking era in the trading universe.

At the vanguard, features like auto-discovery of Fair Value Gaps take the limelight. This tool is not merely advanced; it’s a lighthouse for traders navigating the intricate oceans of trading, offering lucid insight into potential opportunities hidden within the market’s ups and downs. Such insight is essential for making timely, informed trading choices, a key aspect for ensuring optimal trading results.

Furthermore, platforms are now advancing by offering auto-drawing of Fibonacci sequences. This is not just a technical upgrade; it epitomizes ease and precision, smoothing the application of ICT trading principles. This amalgamation is reshaping the trading panorama, making it more accessible for even those starting their trading journey. It’s equalizing the terrain, ensuring every trader, regardless of their experience, has access to the sturdy tools needed for successful trading.

A revolution

In addition, the integration of ICT concepts in platforms is reshaping the trading environment. It is making the arduous task of understanding and applying intricate trading concepts a breeze, ensuring traders spend less time grappling with complex tools and more time making strategic trading decisions. This transformation is not just a change; it’s a revolution, paving the way for a more efficient, effective, and inclusive trading ecosystem.

In conclusion, the utilization of ICT concepts in platforms like TrendSpider is not just a technical enhancement; it’s a holistic improvement in the world of trading. It’s opening doors, broadening horizons, and ensuring that traders are equipped with the best tools as they navigate the challenging and exciting world of trading. So, embrace this integration, leverage the enhanced features, and propel your trading journey to unprecedented heights of success and satisfaction.

Optimal Trade Entry and Balanced Price Range in ICT Trading

In the world of ICT trading, the emphasis placed on pinpointing the optimal trade entry is undeniable. It is more than a mere strategy; it is a foundational element that stands tall in the hierarchy of trading principles. ICT trading intricately unveils the secrets to identifying optimal trade entries, which characteristically lie between the 60 % and 80 % retracement of an expansion range. This specific positioning is not arbitrarily chosen; it is a product of meticulous calculation and analysis, a mirror reflecting the market’s heartbeat.

Beyond just numbers and percentages, understanding these entries contributes significantly to the tapestry of trading decisions. It illuminates the path for traders, guiding them through the labyrinth of market movements, and helping them position their trades with an enhanced precision and understanding. This keen insight is not just beneficial; it is instrumental in navigating the turbulent waters of the forex marketplace, ensuring traders sail smoothly towards the shores of profitability.

Balanced Price Ranges

But the journey does not end here. ICT trading also magnifies the importance of comprehending Balanced Price Ranges. This concept is a pillar supporting the robust structure of ICT trading, holding a pivotal role in the grand scheme of trading strategies. Balanced Price Ranges offer a panoramic view of market stability, allowing traders to gauge the equilibrium between supply and demand.

The profound understanding of these balanced ranges aids traders in making more strategic and informed decisions, fortifying their trading approaches with an additional layer of intelligence and insight. It is not just a technique; it is a lens through which traders can view the market, providing clarity and direction in their trading endeavors. This clarity is paramount, significantly bolstering the potential for increased profitability in trading ventures.

In summation, ICT trading, with its focus on optimal trade entry and Balanced Price Range, is not just a methodology. It’s a comprehensive roadmap, leading traders through the intricacies of the trading world, ensuring they are armed with vital insights and strategies, and ultimately steering them towards the pinnacle of trading success. The journey through ICT trading is an exploration, an unlocking of deeper understanding and expertise, setting the stage for a more strategic, informed, and profitable trading experience.

Unveiling Real-Life Proficiency: EUR/USD Encounter

Imagine a scenario focusing on the EUR/USD currency pair within the ICT trading strategy. As the EUR/USD price begins a retracement, it hits a point within the 60% and 80% range of a prior expansion. This moment is marked as a potential optimal trade entry point. Here, real-time application of the ICT trading principles is in action, bringing abstract concepts into a tangible framework.

At this juncture, a comprehensive understanding of the Balanced Price Range proves indispensable. Observing the EUR/USD, traders discern a stable price range, signifying a balance in buying and selling pressures. This observation becomes a signal for a timely trade entry, aligning with market stability and amplifying the potential for profitable trading.

As the price of EUR/USD undergoes fluctuations, the continuous monitoring and application of ICT principles become crucial. Traders, guided by insights into optimal trade entry and Balanced Price Range, make informed decisions. These decisions may include a timely exit from the trade as the price moves out of the Balanced Price Range, safeguarding profits and minimizing losses.

In this EUR/USD example, the real-world application of ICT trading principles is vividly portrayed, reaffirming their vital role in enhancing trading outcomes. Traders, armed with these insights, adeptly navigate the forex market, making well-informed and strategic decisions, fostering a pathway to consistent trading success.

Navigating the Path to Mastery in ICT Trading

Embarking upon the intricate path of ICT trading is a journey of continuous evolution and adaptation. It’s not a linear path, but a dynamic, ever-evolving learning curve that unwinds with every step taken. It’s about immersing oneself in the richness of its methodology, delving deep into the world where price action and pivotal market concepts reign supreme. This all-encompassing approach equips traders with a robust toolkit, empowering them to traverse the Forex market terrains with bolstered confidence and nuanced insight.

This journey, however, is not about mere surface-level navigation. It’s about delving into the depths of ICT trading, wholeheartedly embracing its foundational and advanced principles. By wrapping these principles around their strategies, traders anchor themselves solidly within the market’s tides, positioning themselves for a more informed, strategic, and successful trading expedition.

Leading traders to unearth the secrets

And this is more than a mere exploration; it’s a dedicated commitment to mastering the realm of ICT trading. It opens up an expansive gateway, leading traders to unearth the secrets, subtleties, and nuances of the Forex market. It ensures they stand well-armored and adept, ready to tackle the continuously shifting landscapes of the trading world with refined acumen, robust strategy, and a clear, unwavering vision.

The world of ICT trading is not just a market; it’s a battlefield, and equipped with the arsenal of knowledge and skills offered by ICT trading principles, traders stand poised for victory. They emerge not just as participants, but as masters navigating the vast expanse of the Forex universe. The mastery of ICT trading, therefore, stands as a beacon, illuminating the path for traders, and guiding them to ascend the pinnacle of trading success with assuredness and proficiency.

Embrace the ICT trading journey, step confidently onto the path, and navigate your way to trading mastery with unwavering precision and insight. Your pathway to mastering the Forex market through ICT trading is not just open; it’s inviting you, assuring that you are robustly equipped to face, embrace, and conquer the myriad dimensions of the trading world with unparalleled strategy and understanding.