KDJ Indicator: Enhances Your Forex Trading

If you’re seeking to elevate your Forex trading game, you’ve likely come across a range of technical indicators. One such tool that stands out from the crowd is the KDJ indicator. As a three-line oscillator, it offers Forex traders crucial insights into market trends and potential buy/sell points. This article will provide a good look at the KDJ indicator, its uses in Forex trading, and why it deserves a spot in your trading toolbox.

Understanding the KDJ Indicator

To start off, the KDJ indicator stands for the ‘Random Index’ indicator, more commonly known as Stochastic Oscillator D%J in the world of trading. It’s composed of three lines—K, D, and J—that move within a range of 0 to 100.

Firstly, the K line, also known as the “Fast Line,” measures the relationship between the current closing price and the recent trading range. The D line, or the “Slow Line,” is simply a moving average of the K line. The third line, J, is where things get interesting. The J line represents the divergence of the D value from the K value. By examining how these three lines interact, you can get a sense of potential price reversals in the market.

Incorporating the Indicator in Forex Trading

As we move further, you may wonder how exactly this KDJ indicator is beneficial for Forex trading. Well, the secret lies in its ability to deliver precise momentum and overbought/oversold signals.

When the K line (Fast Line) crosses above the D line (Slow Line), it typically indicates a buy signal. Conversely, when the K line crosses below the D line, this suggests a sell signal. Meanwhile, the J line plays a pivotal role in identifying divergences and potential price reversals.

Managing Risks

As with all technical indicators, the KDJ indicator should not be used in isolation. Instead, it should be combined with other analysis methods to maximize your Forex trading outcomes. As a rule of thumb, if the KDJ value is below 20, the market is considered oversold, signaling a potential buying opportunity. If it’s above 80, the market is overbought, suggesting a selling opportunity.

Enhancing Your Trading Strategy

By now, you’re aware that the KDJ indicator is a potent tool to have in your Forex trading arsenal. However, it is also critical to understand that its effectiveness lies in your ability to incorporate it into your trading strategy correctly.

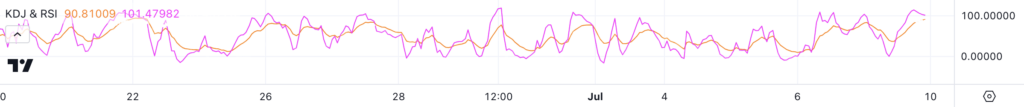

Consider using the indicator alongside other technical indicators such as moving averages or Relative Strength Index (RSI). Doing so can provide more reliable signals, helping you make more informed trading decisions. Also, remember to use stop-loss orders to manage risk effectively.

An Essential Tool for Forex Traders

To sum it up, the KDJ indicator, with its three unique lines, offers traders a wealth of information about market conditions. By providing precise momentum, overbought, and oversold signals, it can significantly enhance your Forex trading strategy.

Remember, trading is an art that requires patience, practice, and the right set of tools. The indicator, coupled with a sound trading strategy, can help you navigate the Forex market with greater confidence and potential success.

A Step-By-Step Guide on Adding the Indicator to TradingView and Other Popular Trading Platforms

Adding the KDJ Indicator on TradingView

- Login to your account: Start by logging into your TradingView account. If you do not have an account, sign up for a free one.

- Open a chart: Select the currency pair or financial instrument of your choice and open the chart.

- Access the indicators: Click on the ‘Indicators’ button at the top of the screen. This will open up a search box.

- Search for the KDJ Indicator: In the search box, type ‘KDJ’ and press enter. A list of related indicators will appear.

- Add the KDJ Indicator: Find ‘Stoch RSI KDJ’ in the search results and click on it. The KDJ indicator will then be added to your chart.

Adding the KDJ Indicator on MetaTrader 4

- Start the platform: Open your MetaTrader 4 platform.

- Open the Navigator: Click on ‘View’ in the toolbar at the top of the screen, then click on ‘Navigator’. The Navigator window will open on the left side of the screen.

- Find the KDJ Indicator: In the Navigator window, click on ‘Indicators’. A list of available indicators will drop down. Scroll down until you find ‘Stochastic Oscillator’, which is what MetaTrader 4 uses for the KDJ Indicator.

- Add the KDJ Indicator: Double-click on ‘Stochastic Oscillator’, and a window with settings will appear. Adjust the settings to match the parameters for K (9), D (3), and J (3) periods, then click ‘OK’. The KDJ indicator will now appear on your chart.

Please note that the MetaTrader 4 platform may not have a direct implementation of the KDJ indicator, but you can use the Stochastic Oscillator to achieve a similar result by adjusting the parameters.

Adding the KDJ Indicator on MetaTrader 5

- Launch the platform: Open your MetaTrader 5 platform.

- Open a chart: Choose the trading pair you’re interested in.

- Access the indicators list: Click on the ‘Insert’ tab at the top of the screen, followed by ‘Indicators’, and then ‘Oscillators’.

- Select the Stochastic Oscillator: As with MetaTrader 4, MetaTrader 5 uses the Stochastic Oscillator as the KDJ Indicator.

- Set up the parameters: Double-click on ‘Stochastic Oscillator’ to open the settings window. Set the parameters for K (9), D (3), and J (3) periods, then click ‘OK’. The KDJ indicator will now be displayed on your chart.