Trend following

Trend following is a trading strategy used to catch the momentum of a market trend. It can be applied in the forex market. The steps to use this strategy, focusing on macro events and technical analysis, are outlined below.

Keeping Abreast of Global Events with Real-Life Examples

Start by consistently following worldwide events. Watch closely for high-impact incidents like the Brexit vote or the U.S. Presidential election.

For example, Brexit in 2016 caused a sharp decline in the British Pound. Investors who kept themselves informed about this political event could anticipate this trend.

Another example is natural disasters. The devastating earthquake and tsunami in Japan in 2011 led to a sudden drop in the value of the Japanese Yen. Alert investors, aware of this, would have been able to make trading decisions based on this downward trend.

Economic announcements, such as changes in the U.S. Federal Reserve’s interest rates and the Non Farm Payrolls, also significantly affect currency values. A decision to increase rates typically strengthens the U.S. Dollar, providing a clear signal for forex trading. These kinds of events are the most common and the easiest macro events to profit from in forex trading as a macro forex trader.

Our go-to source for a comprehensive overview of economic announcements is DailyFX. It allows effortless sorting by region and provides clear insights into the anticipated effects of each announcement.

Regularly following and analyzing such global happenings helps in making more informed, timely, and potentially profitable trading decisions in the forex market.

Anticipating Currency Value Shifts with Real-World Scenarios

After noting major global events, consider their potential effects on currency values.

For instance, in a situation of political unrest, such as the Hong Kong protests in 2019, currencies can depreciate. During these protests, the Hong Kong Dollar experienced volatility.

Similarly, an anticipated economic policy announcement can create currency value fluctuations. Before the U.S. Federal Reserve announces a decision on interest rates, traders often speculate on the outcome. If traders expect an interest rate hike, they might buy the U.S. Dollar in anticipation, causing its value to increase before the actual announcement.

By gauging the possible impact of global events on currencies, you can better predict and react to currency value shifts in the forex market, enhancing your trend-following trading strategy.

Scrutinizing Actual Currency Responses with Examples

Next, carefully observe the actual responses of currencies to major events.

For example, during the U.S.-China trade war, announcements of new tariffs led to fluctuations in the value of both the U.S. Dollar (USD) and the Chinese Yuan (CNY). Observing these reactions, traders saw the USD generally strengthening against the CNY.

Another instance is the 2020 global pandemic. As news of the pandemic spread, many investors sought safety in the U.S. Dollar, observing its strengthening relative to other currencies.

By closely watching how currencies genuinely react to significant events, you discern the trend direction, providing valuable insights for your trend-following forex trading strategy.

Employing Technical Analysis with Practical Tools

Now, solidify the observed trends using technical analysis.

Take the EUR/USD pair as an example. Suppose after a major European economic announcement, you notice the Euro strengthening. To confirm this trend, check forex charts and indicators.

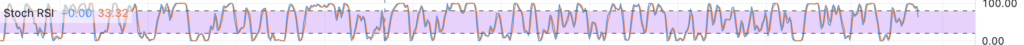

Utilize tools like moving averages. If the Euro’s price is consistently above a moving average, it confirms an upward trend. Use the Relative Strength Index (RSI) as well. An RSI value below 30 can indicate a trend reversal, showing that the Euro might start to strengthen after a downward trend.

By applying technical analysis tools like these, you confirm the trend’s robustness, enhancing your confidence and precision in executing forex trades based on the trend following strategy.

Executing Your Trade with Decision and Timing

When a strong trend is evident, it’s time to act.

For example, suppose after an economic announcement, the Australian Dollar (AUD) starts an upward trend. Technical indicators like moving averages and RSI confirm this upward momentum. In this situation, consider buying (going long) on the AUD.

On the contrary, if after a geopolitical event, you notice and confirm a downward trend in the British Pound (GBP), think about selling (going short) on the GBP.

By astutely observing and confirming trends, decide to buy or sell accordingly, ensuring your trade moves harmoniously with the market momentum, potentially increasing your chances of a profitable trade.

Securing Investments with Stop Loss and Take Profit

With a trade in motion, protection is paramount.

Imagine you’ve gone long on the Canadian Dollar (CAD) based on a positive economic update. Set a stop loss to limit potential losses if the trend reverses. For example, Exit the trade if the CAD falls and losses reach 2% of your account balance.

Similarly, set a take profit to lock in gains. If you’re expecting a rise in the CAD adding 5% to your account balance, set your take profit at that level to automatically close the trade and secure your earnings. A good strategy is to close half of the position when the CAD reaches your limit, while simultaneously moving your stop to the entry price. Of course only if you expect the trend to continue!

These mechanisms safeguard your investments, ensuring that your exposure to loss is limited and your desired profits are secured when targets are reached.

Continual Monitoring and Adjustment for Optimal Outcomes

Lastly, regular oversight and adaptability are key.

Imagine trading the Euro (EUR) based on a positive political update in the European Union. Keep observing the EUR and global events post-trade. If a sudden unexpected event occurs that affects the EUR negatively, be prepared to adjust your position swiftly to minimize losses.

Regularly check technical indicators as well. If they signal a weakening trend, consider exiting the trade earlier than initially planned.

By continually monitoring and being ready to adapt, you optimize your trading strategy, enhancing your ability to safeguard investments and capitalize on favorable trends in the forex market.

A Comprehensive Approach to Forex Trading

In wrapping up, these detailed steps empower you to proficiently use a trend-following strategy in forex trading, grounded on macro events and authenticated with technical analysis.

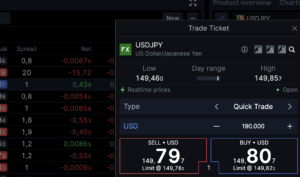

An example to remember: even while trading positively trending currencies like the Japanese Yen (JPY) post-economic upliftment, consistent risk management remains essential.

Maintain a disciplined approach to stop loss and take profit settings, ensuring you guard your investment against unexpected shifts. This method, while offering profitability, requires steadfast risk management to evade substantial losses and preserve your capital in the volatile world of forex trading.