Tick Scalping in Forex: A Beginner’s Guide to High-Frequency Trading

Welcome to MacroFXTrader.com, where we simplify complex trading concepts! Today’s spotlight is on “tick scalping” in forex trading. Perfect for those eager to make quick gains from small market movements.

What is Tick Scalping? Expanding on the High-Speed Trading Strategy

Tick scalping is a fascinating and dynamic approach in the world of forex trading, where speed and precision are paramount. This high-frequency trading strategy is distinctively different from traditional methods. It doesn’t rely on long-term market trends but instead focuses on exploiting minute, rapid changes in currency prices.

At its core, tick scalping is about making numerous trades over a short period. Each trade targets small price movements—often just a few ticks (the smallest price change a currency pair can make). The goal here is not to make significant profits from a single trade but to accumulate small gains that can add up to substantial earnings over time.

This strategy is tailor-made for the forex market, known for its high liquidity and constant movement. Because currencies are traded in such large volumes, even the smallest price fluctuation can be turned into an opportunity by a skilled tick scalper. By entering and exiting trades swiftly, scalpers aim to capture these fleeting changes before the market shifts again.

Tick scalping requires traders to be incredibly alert and responsive. They often make split-second decisions, entering and exiting trades within minutes, if not seconds. This high-speed, high-volume trading can be exhilarating but also demanding, requiring intense focus and a thorough understanding of market signals.

The success of tick scalping also hinges on having the right tools and technology. Fast and reliable trading platforms are essential to execute trades instantaneously. Many scalpers also use automated trading systems or algorithms to help them identify opportunities faster than they could manually. These systems can analyze large amounts of market data, recognize profitable patterns, and execute trades at speeds impossible for human traders.

Despite its potential for quick profits, tick scalping is not without risks. The sheer number of trades made increases the exposure to potential losses, and the fast-paced nature of the strategy can be overwhelming, especially for beginners. It also requires constant market monitoring, making it a time-consuming approach.

In summary, tick scalping in forex is a strategy that suits traders who thrive in a fast-paced environment and are comfortable with taking calculated risks. It’s a world where quick reflexes, sharp analytical skills, and cutting-edge technology come together to exploit the ever-present, small-scale opportunities of the forex market.

Techniques and Tools for Successful Tick Scalping

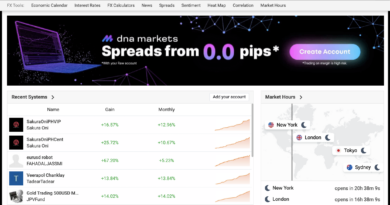

- Tick Charts: Essential for identifying rapid price changes, these charts track the number of trades, not time.

- Speedy Execution: Utilize advanced platforms for instant trade execution.

- Automated Systems: Algorithms and expert advisors for quick, efficient trading.

- Robust Risk Management: With multiple trades, tight stop-loss orders and solid money management are vital.

Why Tick Scalping?

- More Opportunities: Exploit short-term movements for frequent gains.

- Less Overnight Risk: Close positions daily to avoid unexpected market changes.

- Boost Market Liquidity: Your frequent trades add depth to the market, benefiting all.

Is Tick Scalping Right for You?

Tick scalping demands a deep market understanding, state-of-the-art tools, and strict risk management. It’s intense, fast-paced, and not for everyone. But master it, and you could see consistent returns.

FAQ Corner:

- Is tick scalping risky? Yes, due to its rapid nature and volume of trades.

- Do I need special software? Advanced trading platforms and algorithms are recommended.

- How quick are the profits? Profits are small but can accumulate quickly over many trades.