Navigating SPY StockTwits: A Quick Guide to $SPY Conversations on StockTwits

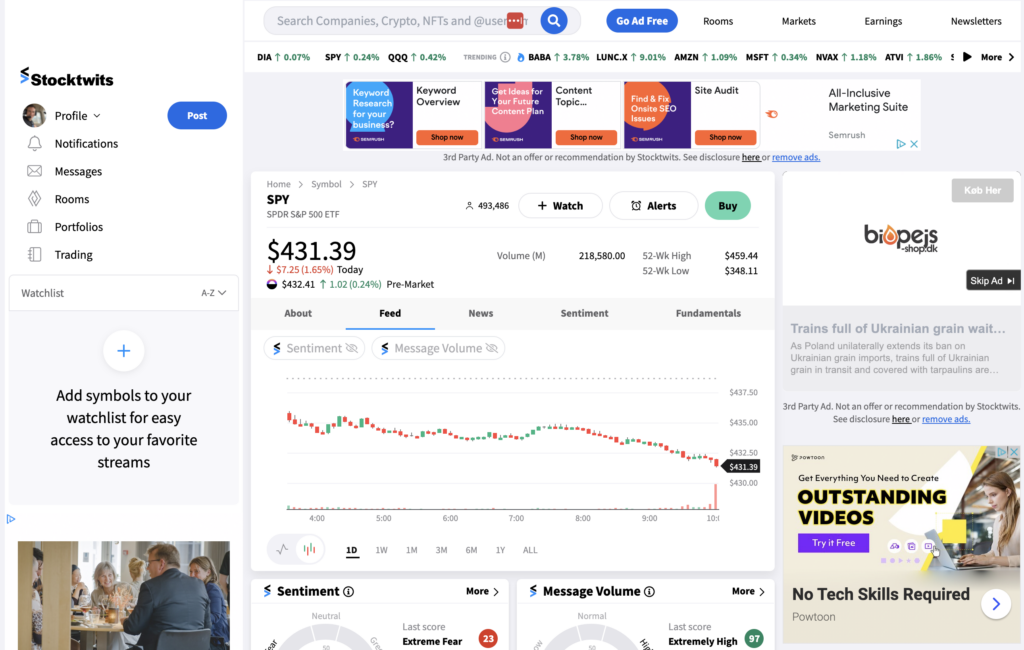

StockTwits is a popular platform where people talk about stocks. On this platform, “SPY StockTwits” and “$SPY StockTwits” are tags used a lot. They focus on an investment fund known as SPDR S&P 500 ETF, or $SPY for short. This fund mimics the S&P 500 index, which is a big deal in the stock market.

On StockTwits, users share quick thoughts under these tags. They might post about price movements or upcoming events. Charts and news articles are also common. This makes it a lively place to gauge what people are thinking about $SPY.

That said, be careful. Not all information may be reliable. Always use other sources to verify what you read. So, if you see a tip or strategy, look elsewhere before acting on it.

So, “SPY StockTwits” and “$SPY StockTwits” offer a snapshot of investor sentiment. They can be useful for quick updates, but always double-check before making investment decisions.

Deciphering Forex Trends Through $SPY StockTwits: What the S&P 500 Can Tell Us About the U.S. Dollar

|  |

Now, let’s talk about how this relates to Forex. Forex is the market for trading currencies. You might wonder, how does $SPY connect to this? Well, $SPY tracks U.S. stocks, represented by the S&P 500.

When the S&P 500 is doing well, confidence in the U.S. economy is usually high. This often leads to a stronger U.S. dollar (USD). On the flip side, if $SPY is down, it might indicate lower confidence. This could mean a weaker USD in the Forex market.

So, if you follow “$SPY StockTwits,” you might get hints about Forex trends too. For instance, if many posts are bearish on $SPY, the USD might also be in for a tough time.

However, be cautious. Correlations between markets can change. Always use additional data to back up any Forex trades based on $SPY insights.

In short, “$SPY StockTwits” can give you clues about the USD’s direction in the Forex market. But always do extra research before trading and check for other forex related news that could have an effect on the trend indicated at SPY StockTwits.

A Step-by-Step Guide: Using $SPY StockTwits to Gauge EUR/USD Trends

Step 1: Log into StockTwits. Once you’re in, search for the “$SPY StockTwits” tag. This is where people discuss the SPDR S&P 500 ETF, also known as $SPY.

Step 2: Look for general sentiment. Are most posts bullish or bearish? A bullish sentiment on $SPY often means confidence in the U.S. economy. This could strengthen the USD against the Euro (EUR).

Step 3: Pay attention to charts and data. Are there recurring themes or patterns? This could indicate a trend that might also affect the EUR/USD pair in Forex.

Step 4: Take note of important events. Are users discussing upcoming news like jobs reports? Big events can impact both $SPY and EUR/USD.

Step 5: Compare with Forex data. Open your Forex trading platform and look at the EUR/USD chart. Do you see similarities with $SPY trends?

Step 6: Make a test trade. If you see a strong correlation, consider a small test trade on the EUR/USD pair. But be cautious, this is just one indicator.

Step 7: Keep monitoring. Always keep an eye on both “$SPY StockTwits” and your Forex data. Markets can change quickly.

In summary, $SPY StockTwits can offer insights into the EUR/USD Forex pair. But always validate with other data before making any trades.