Forex Trading for Beginners

You’ve probably heard about forex trading. One of the reasons forex trading has become popular is the ability to trade currencies with margins, which allows you to leverage your investments. For instance, with a $5,000 deposit in your trading account, you could trade up to $50,000 worth of XAU/USD (Gold vs. USD) or USD/JPY (USD vs. Yen), depending on the platform‘s leverage ratio.

However, it’s essential to note that leveraging also increases the risk of losses, sometimes even beyond your initial deposit. That’s why it’s crucial to be well-prepared before diving into the world of forex trading.

In this guide, “Forex Trading for Beginners,” we aim to equip you with the knowledge and strategies needed for a successful start in forex trading. The key to success will be adhering to the guidelines provided, creating your own trading rules, and consistently implementing your forex trading strategies.

Let’s embark on this journey together and explore the world of forex trading for beginners, starting with the essentials.

Mastering the Basics: A Comprehensive 10-Step Guide to Forex Trading for Beginners

What is your level of tolerance and trading window?

IUnderstanding how much you’re comfortable losing in each trade is crucial. This awareness not only fosters a balanced approach to forex trading but also guides you in setting up the second most vital component on this list: establishing the stop loss.

As you advance, you’ll tweak your approach, sometimes between trades. Initially, consistency is key. We generally suggest dedicating 10% of total assets to trading. Imagine you have 20,000 USD: 10,000 in equities, 5,000 in bonds, and 3,000 in cash. Based on our advice, 2,000 USD would be set aside for forex trading. We advise allowing for losses between 2.5-5% of your forex investment per trade. In this scenario, that’s 25-50 USD per trade. If you start with losses, adjust to lower the nominal loss until you find success. As profits roll in, you can increase your stake or keep it steady, reducing relative risk.

How much is enough?

In most short term forex trades (ranging from a few minutes to some hours) 2,5 – 5 % should be enough as you probably made a wrong entry if it’s not. On long term trades (days, weeks and months) this is different. This guide focuses on short term forex trades, which is the general focus at MacroFXTrade.com entirely.

The great part of trading forex this way is that there is a limited downside but an unlimited upside.

Stop loss

This is the most important part of forex trading for beginners! It cannot be overstated. As soon as you make a position (go long or short an instrument, such as EURUSD) you have to place a stop loss order that corresponds to your level of tolerance as explained in step 1 straight away. Preferably, you should place the stop-loss order together with your initial order.

Imagine you’ve deposited 1,000 USD into your trading account and decide to buy 10,000 USD worth of XAGUSD (Silver vs. USD). You opt to go long, meaning you’re buying at 20 USD per OZ, considering the spread (we’ll discuss spreads later). Being cautious as a forex trading newbie, you set your stop loss at 2.5% of your trading account balance, which is 25 USD. In relation to the 10,000 USD, this is 0.25%. So, if the silver price drops to 19.95 USD per OZ, accounting for spreads, your stop loss will activate. To summarize, your stop-loss should be set at 19.95 USD per OZ, including the spread.

Dangerous not to use Stop-Loss

The obvious danger by not placing a stop-loss is that the direction of the instrument you have a position in goes the wrong way. Trading forex with margins makes it possible to lose more money than you’ve deposited into your trading account and forex can change in price rapidly in seconds, so it can be very costly to forget. We learned it the hard way. You don’t have to.

When a trade goes your way you should monitor it and move your stop-loss to establish a “safe position“. In this example XAGUSD is rising to 20.15 USD/OZ. You should now consider moving your stop-loss up to around 20.02. In that way you will not experience any loss should XAGUSD go back down before it reaches your limit-order (where you take the profit).

Spreads

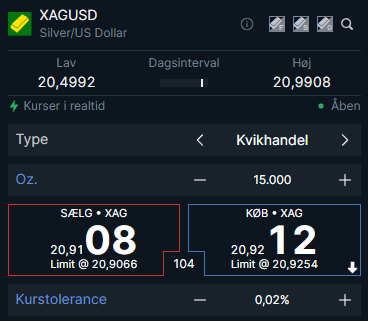

The banks behind the different forex trading platforms are earning their money through spreads. Spreads are actually very simple to understand. It is simply the difference between what price you can buy and sell an instrument such as XAGUSD (Silver as in no.2 ).

In the case of silver it’s common on a normal trading day that the spread is around 00.01 USD / OZ. So for each OZ you’re buying, 00.01 USD is going to the bank. In the previous example we bought 500 OZ (10,000 USD / 20 USD per OZ) generating 5 USD to the bank. We also have to sell it again and then the bank earns yet another 5 USD.

As you can see that is quite a big percentage of your stop loss. 25 USD / 10 USD = 40 %

Find Forex Brokers with Low Spreads

To put it simply, it’s beneficial to choose forex brokers with low spreads and trade during times when the spread is minimal. As you get ready to place a spot order, you can watch spreads in real-time, observing their patterns. Typically, spreads widen when trading volume is scanty and market volatility is high. That’s understandable. However, on a regular trading day, you should wait for the spreads to reach their lower levels. If, over a minute, you notice the spread varies between 85 – 140 (equivalent to 0.0085 – 0.014 USD in our scenario), aim to secure your position closer to the 85 mark.

Here you can see the spread is at 104 or 0.014 USD per OZ

So going back to no. 2. In this case it makes sense to add 0,01 to your stop loss to cover the spread. Therefore your stop loss should be at 19.96 in the example above.

When to buy

After years of forex trading we’re focusing on entering positions (buying or selling instruments such as XAGUSD) on macro events. This can be many sorts of events such as rate decisions from the US Federal Reserve Bank, political unrest such as we have seen in United Kingdom recently or even terrible events such as war or the threat of war.

If the market anticipates a 0.75% US FED rate hike, but only gets 0.50%, the USD is likely to decline against other currencies. For instance, you could go long on EURUSD, essentially buying EUR with USD. If the USD drops and the EUR remains stable or strengthens, you profit. Reacting swiftly to such scenarios is crucial, often within seconds of the announcement. Professionals using tools like the Bloomberg terminal will likely outpace you, preventing you from securing the position at its lowest. However, you have a solid chance of catching an aggressive uptrend, thus ensuring a safe position as explained earlier.

UK as example

If we take the next example of the UK unrest with Brexit and changing prime ministers over and over, that creates uncertainty and thus weakens the pound. Looking back, one of the best forex trades would probably have been shorting GBPUSD. This both on multiple occations on the macro events taking place and overall during the long period the UK has been somewhat unstable.

As for the last theoretical example of war that is obviously not good for any country’s economy. However, if USA is not directly involved the USD will often serve as safe harbor and rally against other currencies. Usually gold will be the ultimate safe harbor, however in periods with high inflation and central banks being hawkish, gold will fall against currencies with hawkish, credible central banks. In short, war is usually bad for the currencies of the countries involved and those currencies should therefore be shorted. Often gold will be good in that case to buy against the currencies e.g. XAUEUR.

Beware of Volatility

Beware that volatility can be very high during these event, so if you want to be pretty sure to have your stop loss working you should place the stop loss order together with the actual order or very fast thereafter, when more experienced in trading. We write “pretty sure” as in very volatile environments you might not be able to close your position at your stop loss. If many traders wants to sell at the same time a buyer for your position might be further south on the graph than you would like it to be. This is not very common but it does happen.

Summarized, you should trade when several indicators point towards the direction you want to enter. First of all the actual macro event but especially having in mind this is forex trading for beginners, so you should be extra careful and add trade signals plus fundamentals to confirm a trade is as safe as possible.

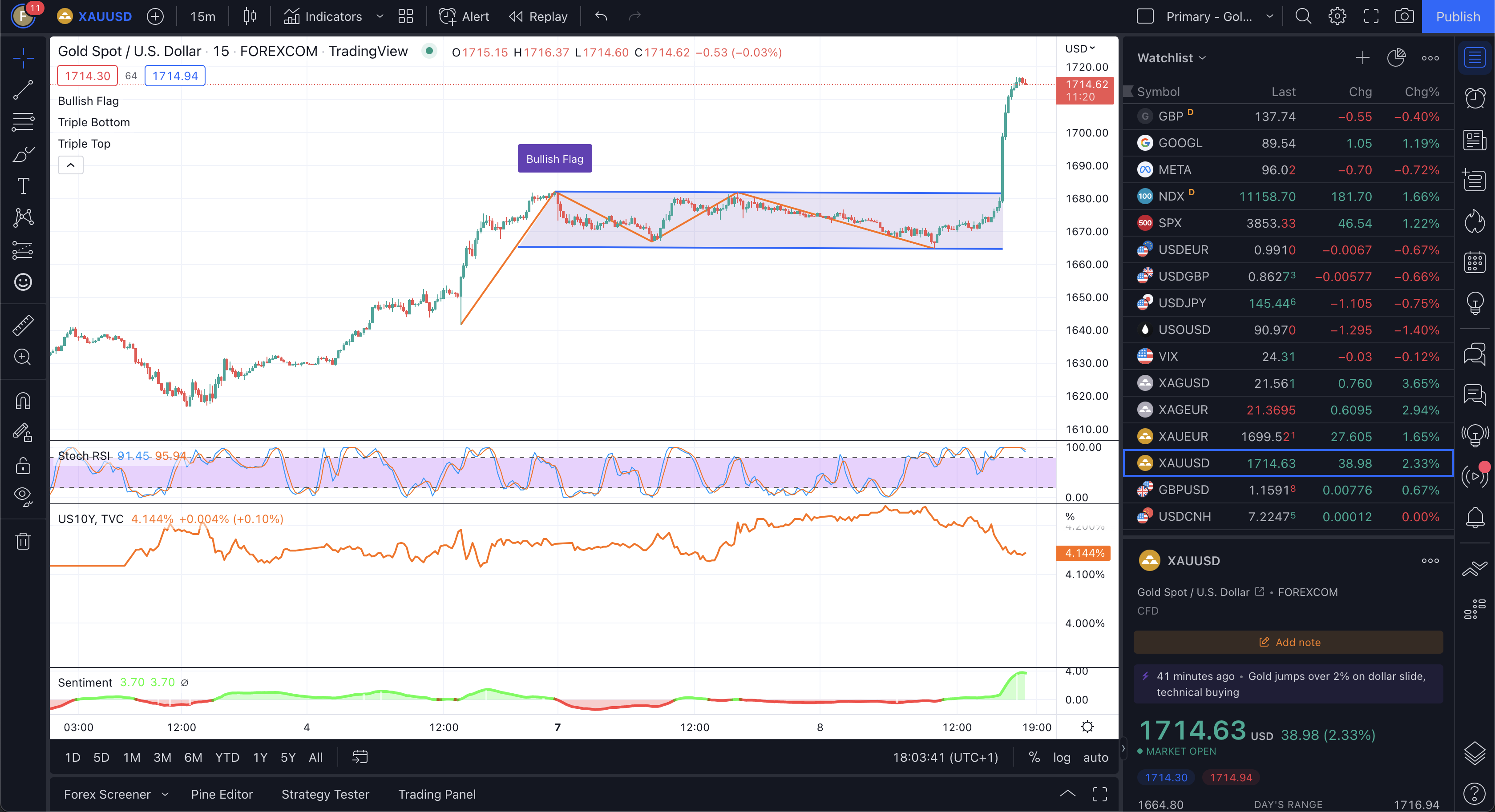

Trade signals

There’re a number of trade signals that can be used as indicators of which direction an instrument might go. These are being calculated from different algorithms depending on which you use and on which instrument they has been made for. The algorithms are in general based on how data has performed historically and then the algorithm is being applied to the current data, which far from always is adaptable in the given conditions. Trade signals are however self-reinforcing as many traders are trading based on the trade signals and some have placed orders in advance that will be triggered, when instruments reach different levels of resistance and support.

A “Bull Flag” in TradingView that indicates XAUUSD is about to increase in value and in this case it did

Don’t base your trades completely on Tradesignals

In summary, while trade signals are valuable, we advise against relying solely on them for trading. This holds true even if some display promising historical results, especially for forex trading beginners. One of our favorites, should it be used as a lone indicator for trades, is the Gold Prediction and Signals, where if you have time can make a profit in most cases solely by using this trade signal on 15 minutes candles. The true test lies in trading only upon receiving a signal, which might require 23-hour daily monitoring or developing an AI to trade based on it.

Example of Gold Prediction and Signals

There are tons of different trade signals in most forex trading platforms and tools such as TradingView etc. You’ll need to identify tools that best match your profile and preferences. Optimize them for maximum efficacy. If you’re skilled in programming and seasoned in trading, you can craft custom scripts for trade signals tailored just for you.

Fundamentals

Fundamentals reflect each trader’s personal market interpretation, shaped by their intake of news and data. Essentially, it’s all about psychology. Gold, for instance, might be undervalued, but unless the majority believes this, its price won’t reflect its true worth. Perhaps they lack the information you have. Timing is crucial; you need to anticipate when they’ll catch on. Broadly, if major US financial media reports on an issue, influential investors will act. But if only local news covers a big event, global markets may remain unaffected. In essence, fundamentals represent your informed predictions about future events.

This is particular important if you are entering forex trading for beginners with the idea of trading long term. You might have an idea of gold increasing rapidly in value over the next year. We had a similar approach in the beginning of our trading carreer and it served us well.

Entrypoints are the key

We find it harder to keep a forex position for a long time the tighter the stop loss is though. We also know the same is the case if a market or an instrument is volatile. So the entry is key yet again. Enter long positions when the instrument is near a local minima and macro events makes it go up again. Preferebly together with trade signals pointing in the same direction. Then add more slack to your stop loss than you normally would do in short term trades.

We do however in general recommend trading on short term basis. In that way you can enter several ups and downs with long and short positions generating much more profit in total. You should use fundamentals together with the other tools, when you enter or exit an position. Do this in real life by keeping yourself up to date with trusted macro news from sources such as Bloomberg, MarketWatch, Saxo Bank an similar. Then only enter trades, where fundamentals supports the direction you wish to enter and close your position, when changes to this are coming backed up by other indicators, such as techinal.

When to sell

This obviously varies a lot from case to case, from instrument to instrument and is depending on your level of tolerance. There’re however some simple indicators that can be used and in time your intuition will be important here as well.

The most concrete tools you can use to begin with are resistance and support levels. Resistance levels indicates, where on the way up an instrument is expected to experience resistance. This is due to technical data and trading signals, which technical traders follows – and AI’s too. Therefore it’s very likely that positions will be sold at those levels to some extent. Therefore, this often makes up an excellent level to close your successful positions at!

When Shorting

We also recommend the same approach, when you short (sell something you don’t have instead of buying it). Here it’s just support levels you’re looking for instead of resistance levels. Support levels indicates, where instruments are expected to bounce back up.

While exceptions exist, it’s prudent to initially adhere to this advice. Over time, familiarity with your trading instruments will foster intuition about when to retain positions. For instance, EURUSD could surpass multiple resistance levels if the ECB unexpectedly raises rates by 0.5% instead of lowering them.

Beware of Resistance/Support Levels

When setting a limit order, ensure you place it slightly below/above the resistance/support level. This accounts for spreads and other traders’ actions. If you don’t, you risk missing your profit target due to others closing positions, affecting the price direction. For example, if EURUSD has resistance at 1.05658, set your limit order near 1.0560, 5 pips lower.

To find these levels, search on Google or check your trading platform. Always be updated before initiating a trade.

Trading discipline

Develop your strategy and trading rules and do not divert from those! This is very important because you will get tempted to trade on news, data and signals, which does not live up to your standards of trading all the time. When you’ve had a good start trading forex as a beginner it’s very important to stay on track. It’s so important that we have written a whole strategy-article about it, which you can read here. Had we followed this rule from start until now we would have had profits more than 1,000 % higher than we’ve now.

So when does the danger of diverting from ones strategy occur? There are many points, where this can happen, but here are some of the most common scenarios:

- In case of FOMO (fear of missing out)

- Trading on news on from a source not used by most traders

- Trading on data releases not considered important by most traders

- After a winning streak followed by greed or the feeling of invincibility

- After a loosing streak followed by irritation and the need to “win back” the lost money

- On technical trades without consideration of important fundamental developments

When does losses occur?

Specific situations where we’ve lost on trades, that had not been entered, had we followed our own strategy and rules:

- When Powell is speaking. This rule exists because extreme volatility often hits our stop-loss, even when our direction is correct. Yet, the allure of such events tempts us repeatedly, typically resulting in losses.

- Trading against the market. It’s easy to mix up information that you’ve, which relates to the near term, medium term and long term. For instance, we’ve long been bullish on gold. When its price drops, we’re tempted to go long, anticipating a rise. Despite knowing it might decline further short-term, we sometimes overlook our macro forex strategy’s short-term focus and mistakenly consider long-term positions.

- Using high margin trades with volatile instruments can be tempting given our confidence in our trading decisions. However, this can be risky. For instance, opting for 25,000 oz of XAGUSD over 250 oz of XAUUSD can amplify risks. Margin usage should align with your strategy. Mistakes in this regard have led us to hit our stop-loss multiple times. When we traded cautiously with less margin on familiar, less volatile instruments, we often avoided losses and secured profits.

Scalping

If you’re really dedicated, motivated and want to earn money on daytrading right away, then scalping might be the right thing to start out with. It goes somewhat against our general topic here on MacroFXTrader.com as we trade forex short term on macro events. But we have been scalping as well back in the days and it’s an easy way to make profit. It’s also our most succesful single strategy with a successrate of around 90 % in our tests.

What’s scalping? It’s leveraging involatile instruments to profit from their local trading range. For example, XAUUSD might fluctuate narrowly between 1721.5 to 1725.5 USD/OZ during calm periods. These stretches often last a few hours. During this time, FX traders can scalp around 3 – 6 times. This continues until market shifts, driven by technical or fundamental changes, disrupt the channel.

Scalping Example

This is a fine example. Gold is moving for more than 12 hours between 1721.5 and 1725.5 USD/OZ. Scalping here would enable us to make profit 3 – 4 times during those hours. It would probably yield around 3 USD/OZ per trade. So trading 500 OZ of XAUUSD, which is normal for us, would generate around 4,500 USD in profits over 12 hours. That is a pretty good hourly pay.

Why don’t we always scalp? Firstly, it’s time-consuming. You must continuously monitor and trade. Secondly, trading always presents risks. However, scalping offers beginners a great entry into forex. Moreover, it familiarizes you with your chosen instrument and platform. Additionally, consistent scalping can elevate your trader status. This can lead to reduced spreads and special VIP event access, akin to a trader’s credit score.

Summary

So, to conclude you should be focused on the following in forex trading for beginners:

- Determine your overall and per-trade risk.

- Always implement a stop-loss for every position.

- Aim for the lowest spreads and be mindful of them.

- Base positions on macro news, backed by fundamentals and technicals.

- Utilize trade signals for entry and exit points.

- Stay updated on fundamentals daily and before any trade.

- Exit positions at support and resistance thresholds.

- Trade strictly according to your predefined strategy and rules.

- Begin with scalping to accumulate capital for higher-risk/reward trades.

Did you like this content?

We trust you found value in our “Forex Trading for Beginners” guide. This resource is the culmination of a decade of experience, including insights from over 1,000 podcasts, countless books, and interactions with seasoned FX traders and experts. We’ve designed it to kickstart your forex daytrading journey. Should you have any feedback, suggestions, or queries, kindly drop them in the comments, and we’ll address them promptly.

For more insights, don’t miss out on our YouTube channel! If this guide resonated with you, we’d be grateful if you could share it with friends or fellow enthusiasts. Mentioning MacroFXTrader.com on your website or joining us on Twitter ensures you stay updated with real-time trading tips from our team. Happy trading!