Comparing Tradovate Margins: How Do They Stack Up Against Other Platforms?

So, you’re in the market for a new trading platform. Maybe you’re a seasoned trader, or perhaps you’re just starting out. Either way, you’ve heard the buzz about Tradovate. You might be wondering, “How do Tradovate’s margin options stack up against the competition?” It’s a vital question. After all, margin trading can be a game-changer in your financial journey. In this in-depth article, we’re going to dissect Tradovate margins. We’ll contrast them with other popular platforms. Our aim? To give you all the information you need to make an educated choice. So, read on to explore the ins and outs of Tradovate margins and see how they compare to your other options.

The Basics of Tradovate Margins

Before we dive into comparisons, let’s get clear on the basics of Tradovate margins. What exactly are they? In the simplest terms, margins are the funds you’re required to have in your trading account. Why is this important? These funds act as a safety net. They serve as collateral, enabling you to make trades that are larger than what your existing capital would otherwise allow. Now, you might be thinking, “Is this borrowed money?” Good question! The answer is no. Unlike a loan, these funds are essentially your own money set aside to cover potential losses. Understanding this foundational concept is crucial, as it will help you make sense of how Tradovate compares to other trading platforms in the margin department.

Tradovate vs. Other Platforms

Alright, now that we’ve covered the basics, let’s jump into the heart of the matter: how do Tradovate’s day trading margins compare with those of other platforms? The first thing to note is that Tradovate offers generally lower day trading margins. This is more than just a minor benefit—it’s a significant advantage. Why? Well, lower margins mean you can initiate trades with less money upfront. This grants you higher leverage, allowing for the potential of increased returns. But how does this contrast with other platforms? Many competitors often set higher day trading margins. What’s the impact? Simply put, higher margins can limit your leverage, making it more challenging to maximize your profits.

| Broker | Typical Day Trading Margin Requirements for Futures |

|---|---|

| Tradovate | $500 per contract |

| TD Ameritrade | $1,000 – $2,000 per contract |

| Interactive Brokers | $1,000 – $2,000 per contract |

| E*TRADE | $1,000 – $1,500 per contract |

| Charles Schwab | $1,000 – $2,000 per contract |

| Fidelity | $1,000 – $2,000 per contract |

| Robinhood | Not applicable (doesn’t offer futures trading) |

| Webull | $500 – $1,000 per contract |

| Ally Invest | $1,000 – $1,500 per contract |

| Merrill Edge | $1,000 – $2,000 per contract |

| Questrade | $1,000 – $2,000 per contract |

As you can see, Tradovate’s typical day trading margin of $500 per contract is generally lower than many of its competitors. This affords you the chance to make trades with less upfront capital, giving you greater leverage and the potential for higher returns.

Overnight Margins: The Tradovate Difference

So, you’ve got the scoop on day trading margins. But what if you’re more of an overnight trader? That’s where Tradovate’s policy on overnight margins comes into play. Unlike day trading, holding a position overnight usually requires higher margins. This is a common practice, not just exclusive to Tradovate. But here’s where it gets interesting: the specific margin amounts can differ from one platform to another. So, how does Tradovate compare? The answer lies in the fine print. Each platform will have its own set of rules for overnight trading, and Tradovate is no exception. It’s absolutely critical to comb through these details. Doing so will help you see how Tradovate stands out or aligns with other trading platforms when it comes to overnight margins.

Margin Calls: Tradovate vs. The Rest

Alright, let’s delve into a topic no trader wants to face, but every trader should understand: margin calls. What happens if your account dips below the required margin level in Tradovate? You’ll get what’s known as a margin call. Essentially, this is an urgent notification telling you to top off your account. Now, you might be wondering, “Is this unique to Tradovate?” The answer is no; margin calls are a universal feature across trading platforms. However, what sets Tradovate apart is the speed and clarity of its communication. When that dreaded margin call comes, you’ll know about it promptly. This quick notification allows you to take immediate action, whether that’s depositing more funds or closing out positions. So, when we talk about Tradovate vs. the rest, their efficiency in communication gives them an edge, especially in situations where every second counts.

Risk Management Tools: Tradovate’s User-Friendly Advantage

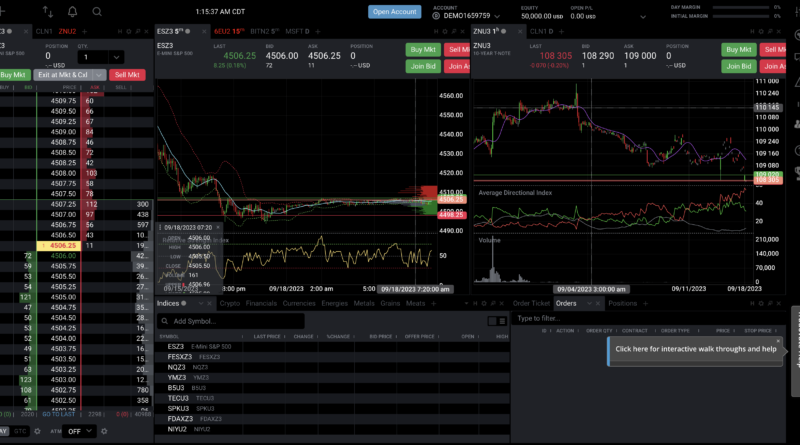

Risk management is not just a buzzword; it’s an essential aspect of trading that you can’t afford to overlook. So, what tools does Tradovate offer to help you in this area? One standout feature is the availability of stop-loss orders. These are mechanisms that can automatically close your position if the market turns against you. Sounds straightforward, right? But here’s the kicker: many trading platforms offer similar risk management tools. So what makes Tradovate special? It’s all about the user experience. Tradovate’s interface is incredibly user-friendly, making it exceptionally easy to set up these safety nets. In contrast, other platforms might offer the same tools but with a more complicated setup process. In a world where every second counts, Tradovate’s ease of use can be a real game-changer.

A thorough exploration of Tradovate’s margin policies

This was a thorough exploration of Tradovate’s margin policies, stacked up against the competition. By now, you should have a clearer idea of what makes Tradovate unique in the trading landscape. From its generally lower day trading margins to its speedy communication during margin calls, Tradovate offers several features designed to improve your trading experience. But let’s not forget about risk management. The platform’s user-friendly interface makes it incredibly simple to set up safeguards like stop-loss orders, giving you an extra layer of protection in a volatile market.

In summary, margins are more than just numbers. They’re an integral part of your trading strategy. With the right platform, they can even be a catalyst for your financial growth. If you’re looking for a blend of competitive margins, efficient communication, and easy-to-use risk management tools, Tradovate could very well be your go-to platform. Your next move? Dive in, do your own research, and see if Tradovate is the right fit for you. You can try their platform risk-free with a unlimited demo account: