Fair Value Gaps (FVG)

To understand Fair Value Gaps (FVG) in Forex we need to understand the expression “fair value”. Fair value signifies the perceived or theoretical value of a currency pair. Unlike in equity markets, this concept in forex is less straightforward due to various influencing factors. Remember, forex is a decentralized market, leading to different players having varied views on a currency pair’s fair value.

| How can I use Fair Value Gaps in my Forex Trading? Key Strategies for Identifying Fair Value Gaps in Forex Trading | USD/EUR Real Life Example More on FVG (Video) |

A fair value gap in Forex occurs when the current exchange rate of a currency pair significantly deviates from its perceived fair value. This can be the result of various factors including:

- Economic Fundamentals: Changes in economic indicators, such as GDP growth rates, inflation, interest rates, unemployment, etc., can cause a fair value gap. For example, if the interest rates in the United States increase, the value of the US dollar would theoretically increase against other currencies. If the exchange rates do not reflect this change, a fair value gap might occur.

- Market Sentiment: In the short term, the exchange rate can deviate significantly from the fair value due to market sentiment. This can be due to geopolitical events, natural disasters, market panic, etc.

- Intervention by Central Banks: Sometimes, central banks intervene in the forex market to stabilize their currency or to adjust its value for economic reasons. This can create a temporary fair value gap.

- Arbitrage Opportunities: In a perfectly efficient market, arbitrage opportunities should not exist. However, due to various factors like transaction costs, differences in market access, information asymmetry, etc., arbitrage opportunities might appear in the forex market, causing a fair value gap.

Traders and investors in the Forex market often attempt to identify these fair value gaps as part of their trading strategy. By buying undervalued currencies and selling overvalued ones, they aim to profit when the market corrects these discrepancies. However, it’s important to remember that predicting these movements can be very challenging due to the complexity and highly dynamic nature of the forex market.

How can I use Fair Value Gaps in my Forex Trading?

Fair value gaps can potentially be utilized as part of your Forex trading strategy. Remember, the “fair value” concept in Forex is subjective. It can vary widely among traders, dependent on their analysis and perspective.

Here are some ways you might use fair value gaps (FVG) in your trading strategy:

- Fundamental Analysis: Use economic indicators to evaluate the fair value of a currency. For example, a country with strong economic growth, low inflation, and high interest rates will likely have a strong currency. If the current market price does not reflect this, it could indicate a fair value gap.

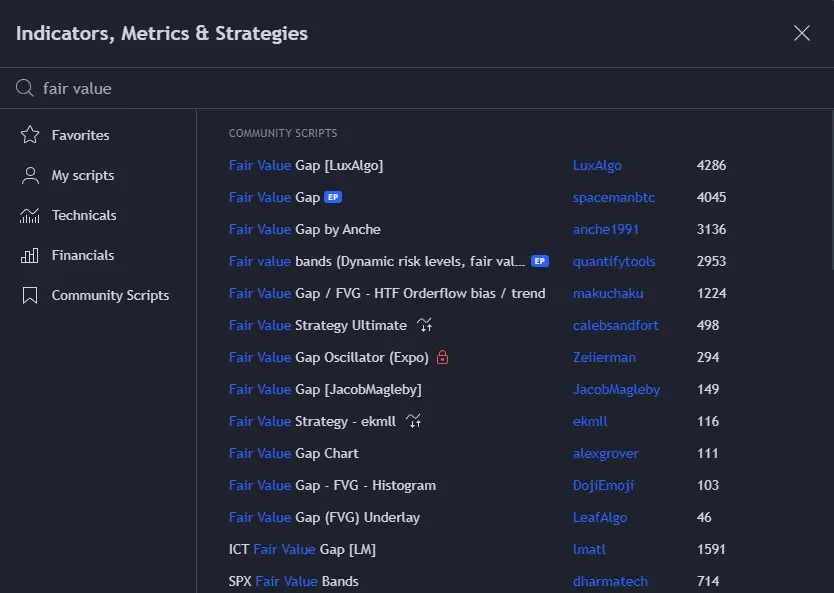

- Technical Analysis: You might also identify fair value gaps by using technical analysis, i.e., the study of price charts and patterns. Traders often use tools like Fair Value Gap scripts (such as LuxAlgo‘s in the TradingView screenshot below) Fibonacci retracements, moving averages, or pivot points to find price levels that may represent fair value. If the market price is far from these levels, a fair value gap might exist.

- Sentiment Analysis: You can also use sentiment analysis to identify fair value gaps (FVG). If the market sentiment is overwhelmingly bullish or bearish, the market price might deviate from the fair value. Various tools like the Commitment of Traders (COT) report, volatility index (VIX), or even social media sentiment analysis can be used for this.

- Carry Trade Strategy: If one currency’s interest rate vastly exceeds another’s, and you foresee a stable or appreciating exchange rate, you have an option. Borrow in the lower interest rate currency, then invest in the higher one. This approach, known as a carry trade, can be applied when a fair value gap arises from interest rate differences.

- Arbitrage: In rare cases, you might identify arbitrage opportunities where you can simultaneously buy and sell a currency pair on different markets to exploit the fair value gap.

Utilizing these strategies can exploit fair value gaps (FVG). However, forex trading involves risk and potential losses. Essential risk management tactics include setting stop-loss and take-profit levels. Diversify your portfolio. Only invest money you can afford to lose. Stay updated on the latest economic news and developments. These can swiftly affect currency values.

You can find several FVG scripts ready to use for technical indication of FVG in e.g. TradingView (simply select “Indicators” and start typing “fair value gap”):

USD/EUR Real Life Example

Consider the USD/EUR currency pair. Suppose you’ve been tracking U.S. and Eurozone economic indicators. The U.S. announces a surprising interest rate hike. Strong GDP growth and employment rates are also present. These factors suggest a strengthening USD.

However, the USD/EUR exchange rate doesn’t mirror this yet. Market inertia or a temporary geopolitical event could be skewing sentiment. Despite robust fundamentals suggesting a stronger USD, it remains undervalued. This situation indicates a “fair value gap.”

A Correction is Incoming

Your analysis predicts a market correction over time. This will strengthen the USD against the Euro, closing the fair value gap (FVG). You could act by purchasing the undervalued USD/EUR pair now. Then, sell it when the USD strengthens and aligns with your perceived fair value.

Remember, this is a simplified scenario. Real-world forex trading is complex and risky. Markets can defy logic longer than your solvency. The expected direction of a currency based on fundamentals might not materialize immediately, or at all.

It’s also important to consider transaction costs and potential changes in other factors, which could influence the exchange rate. Always perform your own due diligence and consider seeking advice from financial advisors.

Understanding Technical FVG Forex Trades

Fair Value Gaps (FVG) are like road signs in forex trading. They show market imbalances using three candles on a chart. The wicks of the first and third candles don’t touch the body of the middle one. The gap between these wicks is your FVG.

Now, let’s talk direction. A bullish FVG means the market could go up. You see it when the low price now is higher than the high price two candles ago. On the other hand, a bearish FVG suggests the market might drop. It appears when the high price now is lower than the low price two candles back.

So, what’s the takeaway? FVGs are great cues for future price action. If you spot one, it’s like the market is giving you a hint. Pay attention, and you could make smarter trades.

Key Strategies for Identifying Fair Value Gaps in Forex Trading

There are several indicators and strategies that can be used to identify and exploit fair value gaps (FVG) in forex trading. It’s important to remember that the effectiveness of these tools can vary based on market conditions and they should be used as part of a comprehensive trading strategy.

- Purchasing Power Parity (PPP): This is an economic theory that suggests that the exchange rate between two countries should be equivalent to the ratio of the countries’ price levels for a fixed basket of goods and services. If the current exchange rate significantly deviates from the PPP exchange rate, a fair value gap might exist.

- Interest Rate Parity (IRP): This is another economic theory which suggests that the difference in the interest rates of two countries should be equal to the difference between the forward exchange rate and the spot exchange rate of the countries’ currencies. If this condition is not met, a fair value gap might exist, potentially leading to an opportunity for a carry trade.

- Relative Economic Indicators: Compare key economic indicators (e.g., GDP growth rate, inflation rate, unemployment rate, etc.) of the countries. If these indicators suggest that a currency should be stronger or weaker than the current exchange rate, a fair value gap (FVG) might exist.

- Price/Earnings Ratios: Some traders use the Price/Earnings (P/E) ratios of major stock indices as an indicator of currency fair value. For example, if the P/E ratio of the U.S. S&P 500 index is significantly higher than the P/E ratio of the UK’s FTSE 100, it might suggest that the GBP is undervalued against the USD.

- Sentiment Indicators: Tools like the Commitment of Traders (COT) report can be used to understand market sentiment. If the majority of traders are long or short on a currency pair, it might suggest that the market price is deviating from the fair value.

- Arbitrage Strategies: These involve simultaneous buying and selling of currency pairs to exploit price discrepancies across different markets. These opportunities are often fleeting and require sophisticated tools and quick execution.

- Fundamental and Technical Analysis: A combination of fundamental analysis (studying economic indicators) and technical analysis (studying price charts and patterns) can also be used to identify potential fair value gaps.