Learn Forex Line Trading

Forex line trading, also known as trendline trading, is a trading strategy in the foreign exchange (forex) market that involves using trendlines to identify potential trade opportunities. Trendlines are lines drawn on a price chart, connecting a series of higher lows (for uptrends) or lower highs (for downtrends). They act as visual representations of market trends and can help traders determine the direction of the market, identify potential entry and exit points, and set stop-loss and take-profit levels.

Content

Overview of Forex Line Trading

Here’s a brief overview of forex line trading:

- Identify the trend

Start by analyzing the forex chart to determine whether the market is in an uptrend, downtrend, or sideways (range-bound) trend. - Draw the trendline

For an uptrend, connect at least two higher lows with a straight line. For a downtrend, connect at least two lower highs with a straight line. The more points the trendline touches, the stronger and more significant the trendline is considered to be. - Trade with the trend

In an uptrend, traders typically look for buying opportunities (long positions) when the price bounces off the trendline, expecting the price to continue rising. In a downtrend, traders usually look for selling opportunities (short positions) when the price rebounds from the trendline, anticipating the price to continue falling. - Set stop-loss and take-profit levels

A stop-loss order should be placed below the trendline in an uptrend or above the trendline in a downtrend to limit potential losses. Take-profit levels can be set using various methods, such as a predetermined risk-reward ratio or by using support and resistance levels. - Monitor and adjust

Keep an eye on the market and adjust your trendlines as needed. Be prepared to exit the trade if the trendline is broken, as this might indicate a trend reversal or the beginning of a range-bound market.

Forex line trading can be a useful technique for both beginner and experienced traders, as it provides a simple and visual way to identify market trends and potential trade setups. However, it’s essential to combine trendline trading with other technical analysis tools and risk management strategies to increase the likelihood of success.

Identify the trend

In forex line trading, one of the most critical steps is identifying the current market trend. Trends are the general direction in which the market is moving, and they can be classified as uptrends, downtrends, or sideways trends (also known as range-bound markets). Understanding the market trend helps traders make informed decisions, develop strategies, and minimize risks. This beginner’s guide will outline the essential steps to identifying the trend in forex line trading.

- Analyze the price chart

Begin by selecting a currency pair (fx. EURUSD) and a time frame that suits your trading style. Short-term traders may use hourly or 15-minute charts, while long-term traders may prefer daily or weekly charts. Observe the price movements on the chart and try to identify any patterns or trends. - Look for higher highs and higher lows (uptrends)

In an uptrend, the market forms a series of higher highs (peaks) and higher lows (troughs). This pattern indicates that buyers are in control and that the market is experiencing sustained demand. In this situation, traders should generally focus on buying opportunities (long positions) to benefit from the rising prices. - Look for lower highs and lower lows (downtrends)

In a downtrend, the market forms a series of lower highs (peaks) and lower lows (troughs). This pattern suggests that sellers are dominating the market and that there is a persistent supply. In this case, traders should generally focus on selling opportunities (short positions) to profit from the falling prices. - Identify sideways trends (range-bound markets)

In a sideways trend, the market moves within a relatively narrow price range, and there is no clear direction. This pattern indicates that neither buyers nor sellers have control, and the market is experiencing indecision or consolidation. In this situation, traders can focus on trading the range by buying near support levels and selling near resistance levels. In such a case, it can be wise to implement a trading strategy, such as Scalping. - Use moving averages

Moving averages are a popular technical analysis tool that can help traders identify trends. They smooth out price data, reducing the noise from short-term price fluctuations and providing a clearer view of the overall trend. To use moving averages, choose a specific period (e.g., 50 or 200 days) and calculate the average closing price for that period. Overlay the moving average on your price chart, and observe how the price interacts with it. Generally, if the price is above the moving average, the market is considered to be in an uptrend, and if the price is below the moving average, the market is in a downtrend. - Combine multiple time frames

To gain a more comprehensive understanding of the market trend, analyze price charts on multiple time frames. This approach provides different perspectives on the market and can help traders identify both short-term and long-term trends. For example, a trader could analyze the trend on daily, 4-hour, and 1-hour charts to determine the overall market direction and potential trade setups. - Adapt to changing trends

Remember that market trends can change over time due to various factors, such as economic events, political developments, or shifts in market sentiment. Stay up-to-date with relevant news and events, and be prepared to adjust your trading strategy if the trend changes.

In conclusion, identifying the trend is a crucial aspect of forex line trading that helps traders make informed decisions and develop effective strategies. By analyzing price charts, looking for specific patterns, and using tools like moving averages, traders can gain insights into the market’s direction and capitalize on potential trading opportunities.

Draw the trendline

Drawing trendlines is an essential skill for traders in the Forex market, as they can help identify the direction of the market, support and resistance levels, and potential entry and exit points. Here’s a step-by-step guide on how to draw trendlines in Forex line trading:

- Choose the time frame

Select a time frame for your analysis. Trendlines can be drawn on any time frame, but the most commonly used ones are the daily, 4-hour, and 1-hour charts. Keep in mind that trendlines drawn on higher time frames are generally more significant than those drawn on lower time frames. - Find significant price points

To draw a trendline, you need to connect at least two significant price points. For an upward trendline, these points would be the lows of the price action, while for a downward trendline, they would be the highs. - Connect the price points

Use a straight line to connect the significant price points. The line should touch as many price points as possible, without cutting through the candle bodies. In some cases, you may need to adjust the line slightly to fit the trend better. - Validate the trendline

A valid trendline must have at least two touches, but the more touches it has, the stronger the trendline becomes. It’s also essential to note that trendlines can be subjective, and different traders may draw slightly different trendlines based on their analysis. - Monitor the trendline

Once you’ve drawn your trendline, monitor it closely. A break of the trendline can signal a change in the market direction or a potential reversal. When the price approaches the trendline, look for trading opportunities in the direction of the trend. - Adjust as necessary

As the market evolves, you may need to adjust or redraw your trendlines. Don’t hesitate to update your analysis to keep up with the changing market conditions.

Remember that drawing trendlines is both an art and a science, and it takes practice to master. As you gain experience, you’ll develop a better understanding of how to draw and use trendlines effectively in your Forex trading.

The attentive trader might have noticed that the trendlines in the picture above indicates a Rising Wedge. The combined with falling volumes indicates a possible bearmarket for the instrument is upcoming. And indeed this is the case here:

Trade with the trend

Trading with the trend is a popular and effective strategy in Forex trading. By following the market’s direction, you increase your chances of success and reduce the risk associated with trading against the trend. Here’s a guide on how to trade with the trend in Forex line trading:

- Determine support and resistance levels

Support and resistance levels are essential for trend trading. They help you identify potential entry and exit points and manage your risk. Draw horizontal lines at significant price levels or use tools like Fibonacci retracements, pivot points, or moving averages to identify these levels. - Use technical indicators

Incorporate technical indicators to help confirm the trend and generate trading signals. Some popular indicators for trend trading are moving averages (e.g., 50, 100, or 200-period), the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD). These indicators can help you confirm the direction of the trend and find potential entry and exit points. - Wait for a pullback

Instead of entering a trade immediately when you identify a trend, wait for a pullback or retracement. This is when the price temporarily moves against the trend before continuing in its original direction. Entering a trade during a pullback can provide a better risk-reward ratio. - Enter the trade

When the price reaches a support or resistance level during a pullback and shows signs of reversing back in the direction of the trend, enter the trade. Use tools like candlestick patterns, RSI, or MACD to help confirm the reversal. - Set stop-loss and take-profit orders

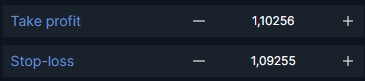

To manage your risk and protect your profits, set stop-loss and take-profit orders. Place the stop-loss order below the support level in an uptrend or above the resistance level in a downtrend. Set the take-profit order at the next significant resistance level (for long trades) or support level (for short trades). - Monitor and adjust

Continuously monitor your trade and the market conditions. Be prepared to adjust your stop-loss and take-profit orders or exit the trade if the trend changes direction. - Stay disciplined

Stick to your trading plan and maintain proper risk management. Avoid the temptation to enter trades based on emotions or overconfidence.

Remember, trading with the trend is a powerful strategy, but no method is foolproof. It’s essential to practice and refine your skills, stay disciplined, and manage your risk effectively.

Set stop-loss and take-profit levels

Setting stop-loss and take-profit levels is crucial in Forex line trading, as it helps you manage risk and lock in profits. Here’s a step-by-step guide on how to set stop-loss and take-profit levels in Forex line trading:

- Determine your risk tolerance

Before you start trading, determine how much risk you’re willing to take on each trade. A common guideline is to risk no more than 1-2% of your account balance per trade. This helps protect your capital and allows you to recover from losing trades more easily. - Calculate the position size

Based on your risk tolerance, calculate the position size for each trade. Divide the amount you’re willing to risk by the number of pips you’ll set as your stop-loss level. This will give you the position size in terms of lots, mini-lots, or micro-lots, depending on your account type. - Identify support and resistance levels

Support and resistance levels play a significant role in determining where to set your stop-loss and take-profit orders. Use technical analysis tools like horizontal lines, trendlines, Fibonacci retracements, or pivot points to identify these levels on your chart. - Set the stop-loss order

Place your stop-loss order at a level where the market would invalidate your trade idea. In other words, if the price reaches this level, it likely means your analysis was incorrect, and it’s time to exit the trade.- For long positions (buying), set the stop-loss order below the support level or a recent swing low.

- For short positions (selling), set the stop-loss order above the resistance level or a recent swing high.

Consider adding a buffer of a few pips to account for market volatility and to avoid being stopped out prematurely due to price spikes. - Set the take-profit order

Your take-profit level should be based on your analysis of the market and your desired risk-reward ratio. A common risk-reward ratio is 1:2 or 1:3, meaning you aim to gain twice or three times the amount you risk on each trade.- For long positions, set the take-profit order at the next significant resistance level or a predetermined number of pips above your entry point.

- For short positions, set the take-profit order at the next significant support level or a predetermined number of pips below your entry point.

- For long positions, set the take-profit order at the next significant resistance level or a predetermined number of pips above your entry point.

- Use trailing stop orders (optional)

A trailing stop order is an advanced order type that allows you to lock in profits as the market moves in your favor. The stop-loss level is adjusted automatically as the price moves, ensuring that you capture more profit if the market continues to trend. Be cautious when using trailing stops, as they can also lead to premature exits if the market experiences a temporary pullback. - Monitor and adjust

Keep an eye on your trades and the market conditions. If necessary, adjust your stop-loss and take-profit levels based on new information or changes in the market. Remember to maintain proper risk management and never risk more than you can afford to lose.

By setting stop-loss and take-profit levels in Forex line trading, you can effectively manage risk, protect your capital, and lock in profits, leading to more successful trades and long-term profitability.

Monitor and adjust

Monitoring and adjusting your trades in Forex line trading is essential to managing your risk, protecting your capital, and maximizing your profits. Here’s a guide on how to monitor and adjust in Forex line trading:

- Keep an eye on your trades

Regularly check your open positions and the overall market conditions. Watch for significant news events, economic data releases, or changes in the market sentiment that could impact your trades. Keep track of the technical indicators and price action patterns you used when entering the trade to see if they still support your original analysis. - Use price alerts

Set price alerts on your trading platform to notify you when the market reaches specific levels. This can help you stay informed about significant price movements without constantly monitoring your charts. - Assess your risk

Continuously evaluate your exposure to risk in the market. Make sure you’re not over-leveraged or overexposed to a particular currency pair or market direction. Adjust your position sizes, stop-loss orders, or take-profit levels accordingly to maintain proper risk management. - Re-evaluate support and resistance levels

As the market evolves, support and resistance levels may change. Update your analysis and adjust your stop-loss and take-profit levels based on the new information. Be cautious not to move your stop-loss orders too close to the current market price, as this could lead to being stopped out prematurely. - Monitor your risk-reward ratio

Keep track of your risk-reward ratio for each trade. If the market conditions change or your analysis is no longer valid, consider adjusting your take-profit levels or exiting the trade to preserve your capital. - Use trailing stops (optional)

If the market is moving strongly in your favor, consider using a trailing stop order to lock in profits while still allowing for potential further gains. A trailing stop order adjusts your stop-loss level automatically as the market moves, capturing more profit if the market continues to trend. Be cautious when using trailing stops, as they can also lead to premature exits if the market experiences a temporary pullback. - Manage your emotions

Stay disciplined and stick to your trading plan. Avoid making impulsive decisions based on fear, greed, or overconfidence. It’s crucial to remain objective and focus on your analysis and risk management strategies. - Review your trades

Regularly review your closed trades to learn from both your successful and unsuccessful trades. Analyze what went right, what went wrong, and how you can improve your trading strategy. This will help you grow as a trader and avoid repeating mistakes.

Monitoring and adjusting your trades in Forex line trading is an ongoing process. By staying disciplined, regularly reviewing your trades, and adapting your strategy to the changing market conditions, you can improve your trading performance and increase your chances of long-term success in the Forex market.