Forex Trading Systems

Forex trading systems are a set of methods, techniques, and tools that traders use to determine when to buy and sell currencies in the foreign exchange market. The systems can be automated or manual and can be based on technical analysis, fundamental analysis, or a combination of both. Technical analysis involves the use of chart patterns and indicators to identify trends and make trading decisions, while fundamental analysis involves studying economic, financial, and political factors to gain insight into a currency’s potential for appreciation or depreciation. Forex trading systems are designed to help traders make informed decisions about when to enter and exit trades in order to maximize profits and minimize losses.

There are many different types of forex trading systems, and each one has its own strengths and weaknesses. Some systems are simple and rely on just a few indicators, while others are more complex and use multiple indicators, algorithms, and other tools.

One type of forex trading system that is popular among traders is the trend-following system. This type of system is designed to identify the direction of the market and enter trades in the same direction as the trend. This can be done using technical analysis techniques such as moving averages, trend lines, and support and resistance levels.

Another type of forex trading system is the countertrend system, which is designed to profit from reversals in the market. This type of system may use technical analysis techniques such as chart patterns and oscillators to identify potential reversal points and enter trades in the opposite direction of the trend.

Some traders use a combination of technical and fundamental analysis in their trading systems. For example, they may use technical analysis to identify entry and exit points and then use fundamental analysis to confirm the trade by looking at economic and political factors that could impact the currency’s value.

It’s important to note that no forex trading system is perfect, and all systems have the potential for both losses and profits. The key to success in forex trading is to have a well-designed and tested system, discipline to follow the rules of the system, and the patience to stay with the system through both winning and losing trades. If you’re new to forex trading we recommend that you read: Forex trading for beginners – 10 easy steps

15 Popular Forex Trading Systems

Here are 15 practical examples of forex trading systems:

- Moving Average Crossover System: This system involves using two moving averages, a short-term and a long-term, to identify the direction of the trend. When the short-term moving average crosses above the long-term moving average, it signals a buy signal, and when it crosses below, it signals a sell signal.

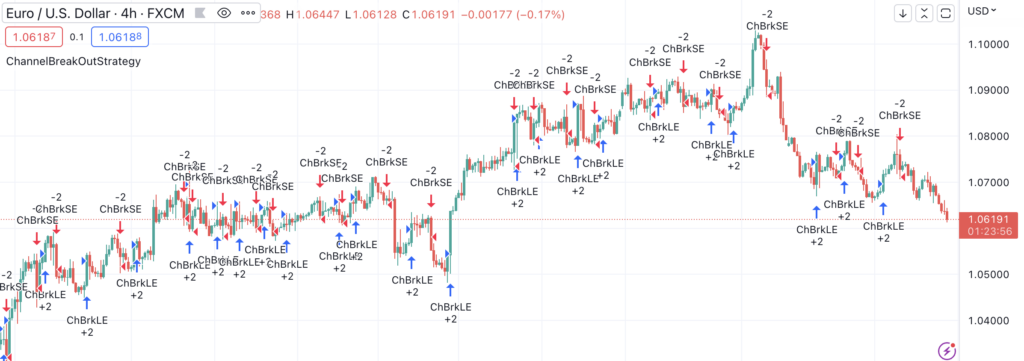

- Breakout Trading System: This system involves identifying key levels of support and resistance and entering trades when the price breaks through these levels. Traders using this system look for price patterns such as triangles and rectangles to identify potential breakouts.

- Trendline Trading System: This system involves drawing trendlines on a chart and entering trades when the price approaches or breaks through these lines. Traders using this system look for confirmed trendlines, meaning those that have been tested multiple times and held as support or resistance.

- Oscillator-Based System: This system involves using oscillators, such as the Relative Strength Index (RSI) or the Stochastic oscillator, to identify overbought or oversold conditions in the market. Traders using this system look for divergences between the price and the oscillator to identify potential reversal points.

- Fundamental Analysis-Based System: This system involves using economic and political factors, such as interest rates, GDP, and political stability, to make trading decisions. Traders using this system monitor news events and economic data releases to gain insight into a currency’s potential for appreciation or depreciation.

- Fibonacci Retracement System: This system involves using Fibonacci retracement levels to identify potential levels of support and resistance in the market. Traders using this system look for price to retrace to these levels and enter trades based on the expected direction of the price after it reaches the level.

- Price Action Trading System: This system involves using chart patterns and price movements to make trading decisions without the use of indicators. Traders using this system look for patterns such as candlestick patterns and chart formations to identify potential entry and exit points.

- Mean Reversion System: This system involves assuming that currency pairs will eventually return to their mean or average price level. Traders using this system look for currency pairs that are overvalued or undervalued and enter trades in the direction of the expected mean reversion.

- Swing Trading System: This system involves holding trades for several days to several weeks in an attempt to profit from medium-term price movements. Traders using this system look for trends and chart patterns to identify potential trades and use stop losses and profit targets to manage risk.

- Scalping System: This system involves entering and exiting trades within a very short time frame, often just a few minutes. Traders using this system look for small price movements and aim to profit from many trades over a short period of time. Scalping can be a high-risk, high-reward strategy and requires a fast-paced, high-pressure trading style.

- Grid Trading System: This system involves placing buy and sell orders at predetermined levels, creating a grid of orders. Traders using this system look to profit from small price movements in any direction by adjusting the grid as the price moves.

- Carry Trade System: This system involves borrowing in a low-interest rate currency and investing in a high-interest rate currency. Traders using this system look to profit from the interest rate differential between the two currencies.

- Martingale System: This system involves increasing the size of a trade after a losing trade in an attempt to recover losses and achieve a profit. Traders using this system need to have a large trading account and be prepared for significant losses if a string of losing trades occurs.

- Hedge Fund System: This system involves using a variety of strategies and techniques to generate profits, often using leverage and derivatives to increase returns. Hedge funds typically require a high minimum investment and are only available to accredited investors.

- Statistical Arbitrage System: This system involves using statistical methods and algorithms to identify and exploit price discrepancies in the market. Traders using this system look for disparities in pricing between similar instruments and enter trades to profit from these differences.

These are just a few examples of the many types of forex trading systems that are used by traders. It’s important to remember that no single system is right for everyone, and each trader should find the system that works best for their individual trading style and goals.

Which of the Forex Trading Systems are the most used?

It’s difficult to say which of these 15 systems are the most used, as different traders have different preferences and may use different systems at different times, depending on market conditions and their individual goals and risk tolerance. However, some of the more commonly used systems include:

- Moving Average Crossover System: This system is popular because it is simple to use and can be applied to any time frame, making it versatile.

- Breakout Trading System: This system is popular because it can be used to trade both short-term and long-term trends and because it can be applied to a variety of markets, including forex, stocks, and commodities.

- Trendline Trading System: This system is popular because it is based on the basic concept of support and resistance, which is widely recognized by traders, and because it can be used to identify both short-term and long-term trends.

- Price Action Trading System: This system is popular because it is based on price movements, which are a direct reflection of market sentiment and supply and demand dynamics, and because it does not rely on indicators, making it straightforward and easy to understand.

- Scalping System: This system is popular among traders who have a high tolerance for risk and who are looking for a fast-paced trading style.

Details on the most used systems

Moving Average Crossover System

The Moving Average Crossover system is a popular forex trading system that involves using two or more moving averages to identify potential trade opportunities. A moving average is a widely used technical analysis indicator that smooths out price data by calculating the average price over a certain number of periods.

In the Moving Average Crossover system, traders look for crossovers, or points where the price crosses over one or more moving averages. These crossovers are used as a signal to enter or exit trades. For example, a trader might use a 20-day and 50-day moving average. If the 20-day moving average crosses above the 50-day moving average, it is seen as a bullish signal, and the trader might enter a long position. Conversely, if the 20-day moving average crosses below the 50-day moving average, it is seen as a bearish signal, and the trader might enter a short position.

The choice of moving average periods and the number of moving averages used can vary depending on the trader’s individual preferences and goals. Some traders might use two moving averages, while others might use more. Additionally, some traders might use exponential moving averages, which place more weight on recent price data, while others might use simple moving averages.

This system can be used on any time frame and in any market, including forex, stocks, and commodities. However, it’s important to remember that this system, like any other system, is not a guarantee of success and can result in losses. Traders using this system should always use proper risk management techniques, such as stop-loss orders, and thoroughly test the system on a demo account before using it with real money.

Breakout Trading System

The Breakout Trading System is a popular forex trading system that is based on the concept of identifying key levels of support and resistance and entering trades when the price breaks through these levels.

In this system, traders identify areas where the price has bounced off a key level of support or resistance in the past, and they use these levels as a reference for entering trades. For example, if the price has bounced off a key level of resistance several times in the past, the trader might enter a short position when the price breaks through this level to the downside. Conversely, if the price has bounced off a key level of support several times in the past, the trader might enter a long position when the price breaks through this level to the upside.

Traders using the Breakout Trading System typically use technical analysis tools, such as trendlines and chart patterns, to identify key levels of support and resistance. Additionally, they might use indicators, such as the Bollinger Bands or the Average True Range, to confirm the strength of the breakout and to help determine appropriate trade management techniques, such as stop-loss orders and profit targets.

This system can be used on any time frame and in any market, including forex, stocks, and commodities. However, it’s important to remember that this system, like any other system, is not a guarantee of success and can result in losses. Traders using this system should always use proper risk management techniques, such as stop-loss orders, and thoroughly test the system on a demo account before using it with real money.

Trendline Trading System

The Trendline Trading System is a popular forex trading system that is based on the concept of using trendlines to identify potential trade opportunities. Trendlines are straight lines drawn on a price chart that connect two or more price points and are used to define the current trend of the market.

In the Trendline Trading System, traders look for the price to approach a previously drawn trendline and then enter trades in the direction of the trend when the price breaks through the trendline. For example, if the price is in an uptrend and approaching a downward sloping trendline, the trader might enter a long position when the price breaks through the trendline to the upside. Conversely, if the price is in a downtrend and approaching an upward sloping trendline, the trader might enter a short position when the price breaks through the trendline to the downside.

Traders using the Trendline Trading System typically use technical analysis tools, such as trendlines and chart patterns, to identify potential trade opportunities. Additionally, they might use indicators, such as moving averages or momentum indicators, to confirm the direction of the trend and to help determine appropriate trade management techniques, such as stop-loss orders and profit targets.

This system can be used on any time frame and in any market, including forex, stocks, and commodities. However, it’s important to remember that this system, like any other system, is not a guarantee of success and can result in losses. Traders using this system should always use proper risk management techniques, such as stop-loss orders, and thoroughly test the system on a demo account before using it with real money.

Price Action Trading System

The Price Action Trading System is a popular forex trading system that is based on the concept of analyzing the price action of an asset to identify potential trade opportunities. Price action refers to the movement of an asset’s price over time and is represented by the formation of candlesticks, bars, or lines on a price chart.

In the Price Action Trading System, traders use charts to identify key levels of support and resistance, as well as patterns in the price action that can provide insight into the direction of the market. For example, traders might look for the formation of candlestick patterns, such as hammers or shooting stars, which can indicate potential reversal points in the market. Additionally, traders might look for the formation of price patterns, such as triangles or head and shoulders, which can provide information about the potential direction of the market.

Traders using the Price Action Trading System do not typically use indicators or other technical analysis tools. Instead, they rely solely on the price action of the asset to inform their trading decisions. This approach is based on the belief that the price action of an asset contains all of the information necessary to make informed trading decisions.

This system can be used on any time frame and in any market, including forex, stocks, and commodities. However, it’s important to remember that this system, like any other system, is not a guarantee of success and can result in losses. Traders using this system should always use proper risk management techniques, such as stop-loss orders, and thoroughly test the system on a demo account before using it with real money.

Scalping System

The Scalping System is a popular forex trading system that is based on the concept of taking advantage of small price movements in the market. In this system, traders enter and exit trades quickly, holding positions for a short period of time in an effort to make a profit from small price movements.

Traders using the Scalping System typically look for markets with high volatility, as this provides opportunities for quick profits. They use technical analysis tools, such as charts and indicators, to identify potential trade opportunities and to inform their trading decisions. Additionally, they might use stop-loss orders to manage their risk and limit potential losses.

In order to be successful using the Scalping System, traders need to have a fast and reliable trading platform, as well as the ability to react quickly to changes in market conditions. This system is not suitable for all traders, as it requires a high level of discipline, patience, and attention to detail.

It’s important to note that scalping can be a high-pressure and high-stress trading approach, and it may not be suitable for everyone. Scalping also involves a high level of risk, as the trader is attempting to profit from small price movements that can quickly turn against them. Traders using this system should thoroughly understand the risks involved and always use proper risk management techniques, such as stop-loss orders.